International Shipping Documents: Everything You Need to Know

Nothing kills the momentum of global trade quite like a shipment stuck at the border. One minute it is moving smoothly, the next it is frozen in place, like a suitcase going around the airport carousel without you. Messages start flying, patience starts disappearing, and everyone assumes something big must have gone wrong.

In reality, it is usually something small. Not a storm, not a broken truck, but a single missing document. Just one piece of paper quietly playing traffic cop, stopping millions of dollars’ worth of goods and turning a simple delivery into an unexpected waiting game.

Getting your international shipping documents in order is the single most important step in moving goods across borders. If you have ever felt overwhelmed by the sheer amount of forms, codes, and legal terms, you are definitely not alone. We have all been there, looking at a stack of paperwork and wondering why it has to be this complicated.

The truth is that these documents are the language of global trade. They tell customs officers what is inside a box, how much it is worth, and where it came from. Without them, the gears of international commerce would grind to a halt. We want to help you navigate this world with confidence. Think of this guide as your roadmap. We are going to walk through every major document you might encounter, explain why it matters, and show you how to handle it like a pro. Whether you are shipping your first product to a customer abroad or managing a complex supply chain, we have your back.

In this comprehensive guide, we are going to cover the essential core documents like commercial invoices and bills of lading. We will also look at the specialized forms required for certain types of goods and the specific rules for shipping into the United States. We have gathered the most practical information to ensure your shipments move smoothly and arrive on time. Our goal is to make sure you never have to worry about a “held in customs” notification again. Let us break this down and get started with the basics.

The Foundation: Core International Shipping Documents

Before we get into the complex stuff, we need to talk about the heavy hitters. These are the documents that appear in almost every single international shipment, regardless of whether you are sending a small parcel or a massive shipping container. What we found is that if you get these right, you have already solved about eighty percent of potential shipping problems. These documents act as the identity card for your shipment. They tell the story of what is being moved, who owns it, and how it is getting to its destination.

The Commercial Invoice: Your Most Important Paperwork

If you only learn about one document today, make it the commercial invoice. This is the bedrock of international trade. It is much more than just a bill. It is a legal document used by customs authorities to determine the value of the goods and calculate the taxes and duties you owe. Every single commodity shipment requires one. If you skip this or fill it out incorrectly, your shipment will almost certainly be delayed.

A good commercial invoice needs to be incredibly detailed. You cannot just write “electronics” and call it a day. You need to specify exactly what the items are, how many there are, and what they are made of. You also need to include the Incoterms, which are the internationally recognized rules that define who is responsible for the costs and risks of the shipment. For a deeper look at how to fill this out correctly, check out our commercial invoice guide. It covers everything from currency codes to harmonized system numbers.

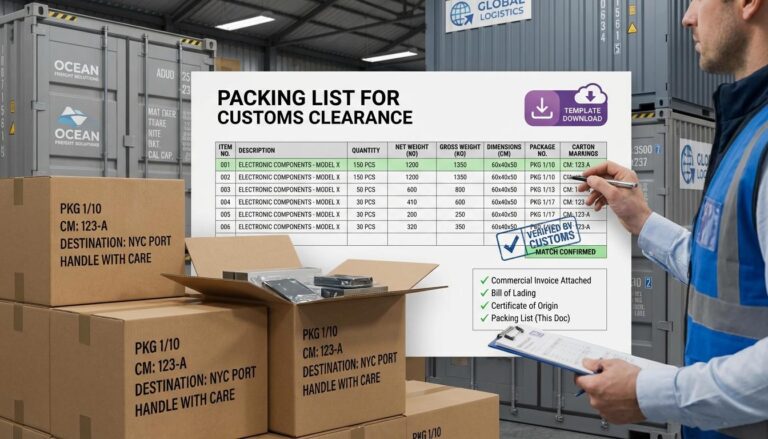

The Packing List: The Physical Map of Your Shipment

Now, you might be wondering why you need a packing list if you already have a commercial invoice. It is a fair question. While the invoice focuses on the value and the “deal,” the packing list focuses on the physical reality of the shipment. It tells the carrier and the customs officer exactly what is inside each individual box. It includes weights, dimensions, and any specific markings on the crates.

Think of it as a tool for the people who have to move your goods. A customs inspector might use it to decide which box to open for a random check. If your packing list says “Box 3 contains red t-shirts” and they open Box 3 to find blue t-shirts, you are going to have a problem. Consistency is the name of the game here. We have a packing list customs template that can help you keep your information organized and accurate every time you ship.

Bill of Lading and Air Waybill: The Contract of Carriage

These two documents serve a similar purpose but depend on how your goods are traveling. If your shipment is going by sea, you will receive a Bill of Lading. This is a fascinating document because it actually serves three different roles. It is a receipt for the goods, a contract between the shipper and the carrier, and a document of title. This means that whoever holds the original Bill of Lading technically owns the goods, when it is issued in negotiable form. There are several types, including Master, House, and Straight Bills of Lading, each with its own specific use case.

On the other hand, if your goods are flying, you will use an Air Waybill. Unlike the Bill of Lading, an Air Waybill is non-negotiable, meaning it does not convey ownership of the goods. It is strictly a contract for transportation and a receipt for the shipper. Both documents include critical tracking numbers and contact information for everyone involved in the journey. Here is the bottom line. You cannot move freight without one of these, so ensure all the names and addresses match your other paperwork exactly.

Customs and Compliance: Proving Your Shipment is Legal

Once you have the basic transport documents ready, you have to satisfy the government officials at the border. This is where customs and compliance documents come into play. These forms are not just about taxes. They are about safety, trade agreements, and national security. This is the part most guides skip over, but it matters because one small error here can lead to heavy fines.

Certificate of Origin: Where Was it Actually Made?

A common misconception is that the “shipping from” address is the same as the country of origin. That is not always true. A product might be shipped from a warehouse in Belgium but actually manufactured in Vietnam. The Certificate of Origin is a document that officially declares where the goods were produced. This is vital because many countries have trade agreements that lower or eliminate tariffs for goods coming from specific nations.

In many cases, these certificates must be authenticated by a local Chamber of Commerce. If you are trying to take advantage of a free trade agreement, like the USMCA or various EU trade deals, you will need this form to prove you qualify. If you want to understand the different versions of this form, we have a great resource on certificate of origin types that breaks down when you need a formal versus an informal version.

Customs Declarations and EEI

Every country has its own version of a customs declaration. In the United States, one of the most important forms for exporters is the Electronic Export Information or EEI. You are generally required to file an EEI if any single commodity in your shipment is valued at over $2,500, with some exceptions. You also have to file it if the goods require an export license, regardless of their value. This information is filed through the Automated Export System and is used by the government to keep track of what is leaving the country.

What this means for you is that you need to be very aware of the value of your goods. If you ship a package worth $3,000 and forget the EEI in a situation where it is required, your shipment will likely be flagged and stopped before it even leaves the port. It is one of those small details that can cause a massive headache if overlooked. Most freight forwarders can help you file this, but the responsibility for the accuracy of the data ultimately lies with you.

Import and Export Licenses

Most everyday items like clothing or books do not require a special license to ship. However, if you are dealing with “controlled” goods, you will need specific government permission. This category includes things like chemicals, high-tech electronics, military equipment, and even some types of wood or food products. According to the U.S. International Trade Administration, it is the shipper’s responsibility to determine if their product requires a license. If you are unsure, it is always better to check with the Bureau of Industry and Security or a similar agency in your country.

Financial and Insurance Documents: Protecting Your Investment

Shipping goods across the world is a financial risk. Ships can encounter storms, planes can be delayed, and sometimes things just go missing. That is why financial and insurance documents are a crucial part of the international shipping documents package. These forms ensure that everyone gets paid and that you are protected if something goes wrong.

The Proforma Invoice: Setting the Stage

Think of a proforma invoice as a “pre-invoice.” It is a quote that looks exactly like a final commercial invoice. It is often used by the buyer to secure financing or to apply for an import license before the shipment actually happens. While it is not a demand for payment, it is generally a good-faith outline of the terms. If you are just starting a relationship with a new international buyer, the proforma invoice is usually the first piece of paperwork you will exchange. It establishes trust and ensures everyone is on the same page regarding prices and shipping terms.

Letters of Credit: The Bank’s Guarantee

When you are dealing with a buyer you do not know well, you might be worried about getting paid. This is where a Letter of Credit comes in. It is basically a guarantee from the buyer’s bank that you will receive your money as long as you provide the required shipping documents. It adds a layer of complexity to your paperwork because the bank will inspect every single document for tiny errors. If the Bill of Lading has a typo, the bank might refuse to pay. It is optional, but for high-value shipments, it provides a level of security that is hard to beat.

The Insurance Certificate

Standard carrier liability is often very low. If a shipping container falls off a ship, the carrier might only be required to pay a few dollars per pound of cargo, which probably will not cover the cost of your goods. An insurance certificate proves that you have purchased additional coverage for the shipment. It details what is covered and how to file a claim. Here is the practical takeaway. Always check your Incoterms to see if you or the buyer is responsible for providing insurance. If you are responsible, do not skip this. The cost is usually a small fraction of the shipment’s value, but it can save your business from a total loss.

Specialized Documents for Unique Goods

Not all shipments are created equal. Some items require extra care or specific certifications to move from one country to another. This is where most people get confused because the rules can change drastically depending on what you are shipping. Let us break down some of the most common specialized documents you might encounter.

Dangerous Goods Declaration

You might be surprised to learn what is considered “dangerous” in the world of shipping. It is not just explosives or toxic chemicals. Lithium batteries, perfumes, and even some types of paint fall into this category. If you are shipping hazardous materials, you must provide a Dangerous Goods Declaration. This document details exactly what the hazard is, how it is packaged, and how it should be handled in an emergency. Failing to declare dangerous goods is not just a paperwork error. It is a serious safety violation that can lead to massive fines and even criminal charges. If you are shipping electronics with batteries, you will want to pay attention to this part.

Phytosanitary Certificates

Are you shipping plants, seeds, or agricultural products? Then you will need a Phytosanitary Certificate. This document is issued by the exporting country’s Department of Agriculture or designated national plant protection organization and certifies that the shipment is free from pests and diseases. Governments are incredibly protective of their local ecosystems, and they do not want foreign bugs or fungi hitching a ride in your shipment. This applies even to things like wooden pallets in some cases. If you do not have the right certificate, customs may order your shipment to be destroyed immediately upon arrival.

Inspection Certificates

Sometimes, a buyer or a government will require a third party to inspect the goods before they leave the factory. This is common for industrial machinery or high-value commodities. An inspection certificate proves that the goods match the quality and quantity described in the contract. It protects the buyer from receiving “junk” and helps the seller prove they fulfilled their end of the bargain. Organizations like SGS or Intertek are often used to provide these independent reports.

Shipping to the United States: A Specific Look

The U.S. has some of the most rigorous shipping requirements in the world. If you are importing goods into the States, there are several unique forms you must be familiar with. Data from U.S. Customs and Border Protection shows that incomplete documentation is a leading cause of shipment delays at American ports.

One of the most critical requirements for ocean shipments is the Importer Security Filing, also known as ISF or “10+2.” This must be filed electronically at least 24 hours before the goods are even loaded onto the ship at the origin port. It requires ten bits of information from the importer and two from the carrier. If you miss this deadline, you can face a $5,000 fine per shipment. It is a strict rule designed to help customs identify high-risk cargo before it reaches U.S. waters.

In addition to the ISF, you might need specialized forms depending on your product. For example:

- FCC 740: Historically required for many devices that emitted radio frequencies, including most electronics, but now largely eliminated for most imports because the Federal Communications Commission has discontinued the form for most products.

- HS-7: Necessary for importing vehicles or vehicle equipment subject to Federal Motor Vehicle Safety Standards to ensure they meet safety standards.

- PPQ 505: Used for permits for plants and plant products under regulations such as the Plant Protection Act, which work alongside the Lacey Act to prevent illegal logging and the spread of pests.

- EPA 3520-1: For importing engines or vehicles to ensure they meet emission standards.

You will also likely need a Customs Power of Attorney if you are using a broker to clear your goods. This legal document gives the broker the authority to act on your behalf. Most people find that working with an experienced customs broker is well worth the cost when dealing with these specific U.S. regulations. They know the nuances of the law and can prevent your shipment from getting stuck in a bureaucratic loop.

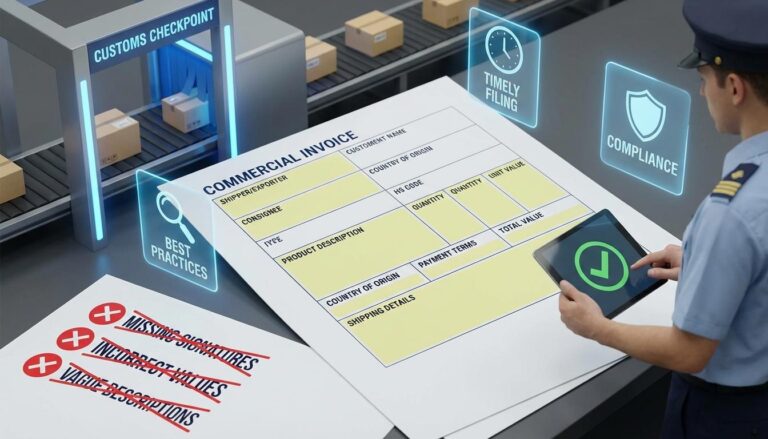

Accuracy and Best Practices: How to Avoid Delays

Now that we have covered the “what,” let us talk about the “how.” Knowing which documents you need is only half the battle. The other half is ensuring they are filled out correctly. What we found is that most delays are caused by small, avoidable mistakes. Here is the thing. Customs officers are not looking for reasons to be difficult. They are looking for reasons to trust that your shipment is what you say it is. If your paperwork is messy or inconsistent, that trust evaporates.

The Power of Consistency

This is where most people get into trouble. Every single document in your shipping package should tell the same story. The value on the Commercial Invoice must match the value on the EEI. The weight on the Packing List must match the weight on the Bill of Lading. Even tiny discrepancies, like a different spelling of a company name, can trigger an audit. We recommend creating a “master” document for each shipment and copying the information directly from there to all other forms. This simple step eliminates a huge amount of human error.

Digital vs. Paper Documentation

The shipping world is slowly moving toward digital documentation, but we are not quite there yet. Many countries still require original paper copies with “wet” ink signatures for certain forms like Certificates of Origin. However, many carriers now accept digital commercial invoices, which can speed up the process significantly. Here is the practical takeaway. Always ask your carrier or freight forwarder exactly what format the destination country requires. Do not assume a PDF is enough until you have confirmation.

Understanding Incoterms

We cannot talk about shipping documents without mentioning Incoterms. These are the three-letter codes like “FOB” or “DDP” that you see on invoices. They define who pays for the shipping, who handles the customs clearance, and at what point the risk of loss transfers from the seller to the buyer. If your invoice says “EXW” (Ex Works), the buyer is responsible for almost everything. If it says “DDP” (Delivered Duty Paid), the seller handles everything, including the taxes in the destination country. You will want to pay attention to this part because choosing the wrong Incoterm can lead to unexpected costs that eat up your entire profit margin.

The Consequences of Poor Documentation

Let us be real for a moment. Shipping documents are boring. It is tempting to rush through them or let a junior staff member handle them without oversight. But the consequences of getting this wrong are very real and very expensive. When a shipment is held in customs, you start racking up fees almost immediately. These are called demurrage and detention charges, and they can easily reach hundreds of dollars per day.

Beyond the immediate costs, there is the damage to your reputation. If you are a business, your customers do not care that customs held up the package because of a missing HS code. They just know their order is late. Frequent shipping delays can lead to lost contracts and a damaged brand. In extreme cases, if customs finds that you have intentionally undervalued goods or misdeclared items to avoid taxes, you could face legal action or be banned from exporting entirely. The time you spend getting the paperwork right is an investment in your company’s survival.

Frequently Asked Questions

What is the most important international shipping document?

The Commercial Invoice is the most important document. It is required for most commodity shipments and serves as the foundation for customs to determine duties, taxes, and the legality of the goods. Without a detailed and accurate commercial invoice, your shipment will not move past the border.

Do I need a Certificate of Origin for every shipment?

No, you do not always need one, but it is highly recommended if you want to benefit from trade agreements. Some countries also mandate it for specific types of goods or for all imports over a certain value. It is always best to check with your buyer or a customs broker to see if the destination country requires it.

What happens if there is a mistake on my Bill of Lading?

A mistake on a Bill of Lading can be a major problem because it is a legal document of title when issued in negotiable form. If the names or descriptions are wrong, you might not be able to claim your goods at the destination. Correcting it usually involves a “Letter of Indemnity” and additional fees from the carrier, so it is vital to review the draft carefully before it is finalized.

Can I just use my standard retail receipt as a commercial invoice?

Generally, no. A standard retail receipt usually lacks the detailed information customs requires, such as the country of origin, the HTS code, and the specific Incoterms. You should create a dedicated commercial invoice that meets international shipping standards to ensure a smooth clearance process.

What is the $2,500 rule for U.S. exports?

If you are exporting from the U.S. and any single commodity in your shipment is valued at more than $2,500, you must usually file Electronic Export Information (EEI) through the Automated Export System, unless a specific exemption applies. This is a mandatory requirement for the government to track trade statistics and ensure compliance with export laws.

Does shipping by air require different documents than shipping by sea?

The core documents like the Commercial Invoice and Packing List remain the same. However, the transport document changes. Sea shipments use a Bill of Lading, while air shipments use an Air Waybill. Air shipments also often have stricter rules regarding “dangerous goods” like batteries due to aviation safety regulations.

Final Thoughts on Mastering Your Shipping Paperwork

We have covered a lot of ground today, and if it feels like a lot to take in, do not worry. International shipping is a complex field, and even the most experienced traders find themselves double-checking the rules from time to time. The key is to take it one step at a time and prioritize accuracy over speed. What we found is that once you establish a solid process for your documentation, it becomes second nature. You will start to see the patterns and understand why each form exists.

Remember, you do not have to do this alone. Utilize resources like freight forwarders, customs brokers, and the official guides provided by trade organizations. These professionals deal with these documents every day and can provide invaluable advice tailored to your specific situation. The good news is that by taking the time to read this guide, you are already ahead of most people. You have a better understanding of the landscape and the potential pitfalls to avoid.

Now you have everything you need to start organizing your international shipping documents with confidence. The next step? Take a look at your current shipping process and see where you can improve your consistency and accuracy. You have got this. Global trade is an exciting journey, and with the right paperwork, the world is truly your market. Are you ready to send your next shipment without the stress of customs delays?