How to Prepare a Commercial Invoice for International Shipping

Are you feeling stuck on how to prepare a commercial invoice for shipping without getting your package held at the border? It is a common hurdle. When you move goods across international lines, the commercial invoice is the most important piece of paper in your hands. We are going to show you exactly how to get it right the first time so you can avoid those frustrating delays and surprise fees. Let us get into the specifics.

You probably already know that shipping internationally is more complex than sending a box across town. While a standard receipt might work for a local customer, customs officers require a much higher level of detail to let your products through. This is the detailed breakdown you have been searching for to handle those international invoice requirements with total confidence. Let us get to the point.

The True Purpose of a Commercial Invoice

A commercial invoice for shipping is much more than just a request for payment. While it does function as a bill of sale between the buyer and seller, its primary job is to act as a declaration for customs authorities. Think of it as the identity card for your shipment. It tells customs officials what is in the box, why it is moving, and how much it is worth.

Here is what that actually looks like in practice. Customs agencies use this document to determine the transaction value of the goods. This value is then used to calculate the specific duties and taxes you or your customer must pay. Without a clear and accurate invoice, customs cannot verify compliance with import and export laws. This is one of those areas where getting it right makes a real difference. If the information is missing or even slightly vague, your shipment will likely be pulled aside for inspection, leading to storage fees and delivery delays.

The practical takeaway is that every piece of information on this document must match your physical shipment exactly. If you say you are shipping ten units but the box contains twelve, you are looking at a red flag. For a complete overview of all the paperwork involved in moving goods across borders, check out our main guide on international shipping documents checklist.

Key Differences: Commercial Invoices vs. Related Documents

One of the biggest mistakes we see is people confusing the commercial invoice with other shipping papers. While they might look similar, they serve very different purposes. Let us look at this closely so you do not use the wrong one at the wrong time.

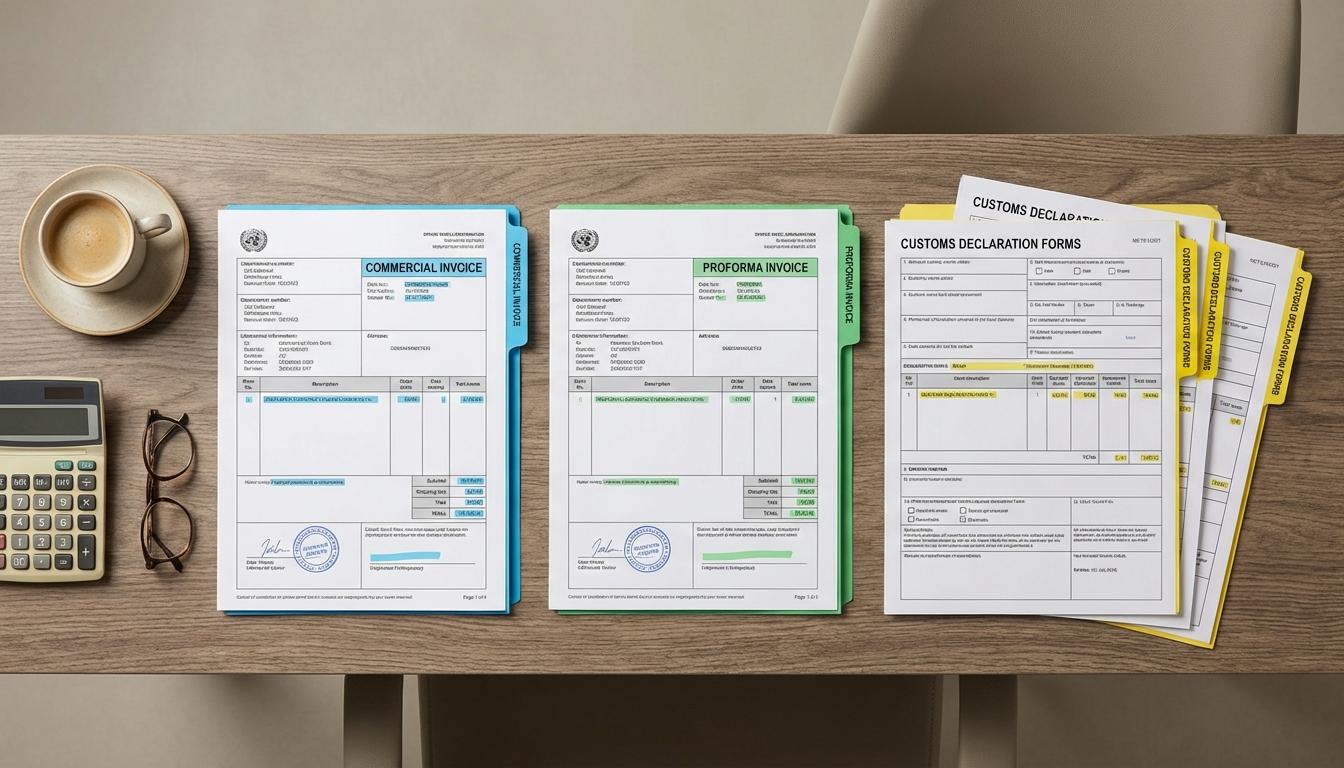

Commercial Invoice vs. Proforma Invoice

The proforma invoice is a preliminary document. It is essentially a quote sent to the buyer before the sale is finalized. While it looks like a commercial invoice, it is rarely used for final customs clearance. The commercial invoice is the final version issued once the sale is confirmed and the goods are ready to move. Use the proforma for negotiations, but always use the commercial version for the actual shipping process.

Commercial Invoice vs. Shipping Invoice

A shipping invoice often focuses on the transport costs, such as freight charges and insurance. In contrast, the export commercial invoice focuses on the value of the goods themselves. Customs cares about the product value more than the freight cost when they are calculating tariffs. You will likely need both, but the commercial invoice is the one that determines the legal entry of the goods into a country.

Commercial Invoice vs. CN22/CN23

If you are using a postal service like USPS or Royal Mail for e-commerce, you might see CN22 or CN23 forms. These are mandatory postal customs declarations. However, for most commercial shipments outside of the EU, a full commercial invoice is still required alongside these forms. Carriers like DHL or FedEx typically rely solely on the commercial invoice rather than postal forms. Your best move here is to provide both if you are using a national postal service to ensure there are no gaps in your documentation.

The Essential Information Required on Every Invoice

When it comes to a customs invoice, specific details are non-negotiable. Governments around the world, including the U.S. Customs and Border Protection (CBP), mandate these fields under regulations like 19 CFR Part 141. If you miss one, your shipment stops. Let us get into the details of what you must include.

- Shipper and Consignee Details: You need full names, physical addresses, and contact numbers for both the seller and the buyer. Do not use P.O. boxes, as customs usually requires a physical location.

- Invoice Number and Date: This is for tracking and auditing purposes. Every shipment should have a unique reference number.

- Reason for Export: Is this a sale, a gift, a sample, or a repair? Be honest here, as this affects the tax rate.

- Country of Origin: This is where the goods were actually manufactured, not just where they are being shipped from. For more on how to document this correctly, see our guide on certificate of origin types.

- Incoterms: These three-letter codes (like FOB or DDP) define who is responsible for shipping costs and risks.

- Currency: Clearly state if the values are in USD, EUR, or another currency to avoid massive valuation errors.

The direct answer to why these fields matter is simple. Customs software automatically flags missing fields. If the currency is missing, the system cannot calculate the tax. If the country of origin is missing, the system cannot apply trade agreements. Accuracy is your best friend here.

Mastering the Product Description

This is where most shippers fail. Using marketing language like “Luxury Skin Care Set” is a recipe for a customs hold. Customs officials do not care about your branding; they care about what the item is made of and what it does. The short version is that your description must be technical and specific.

Here is what works and what does not. Instead of saying “Parts,” say “Stainless steel industrial ball bearings for conveyor belts.” Instead of “Clothing,” say “100% Cotton knitted men’s t-shirts.” Every item must also have an HS (Harmonized System) or HTS code. This is an international six-to-ten-digit number used to classify goods. Using the correct HS code is the detail that changes everything, as it tells the customs agent exactly which tariff rate to apply.

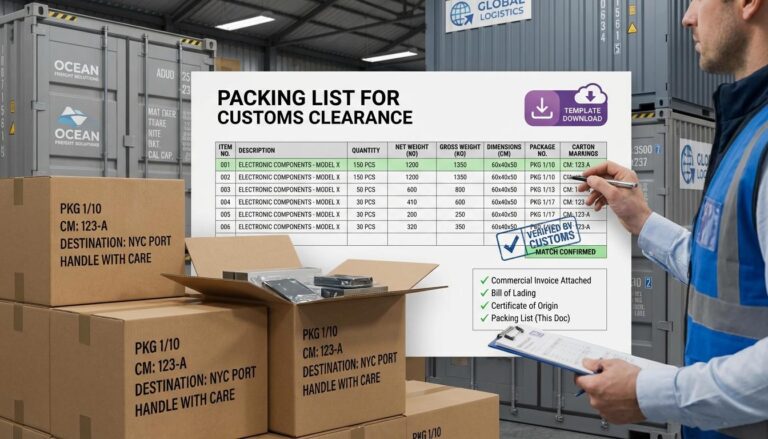

In practice, this means you should match your description on the invoice to your packing list customs template. If the two documents contradict each other, customs will suspect that you are trying to hide something or undervalue the shipment. According to the International Trade Administration, a precise description is the single most effective way to speed up the clearance process.

Understanding Incoterms and Their Impact

Ready for the specifics on Incoterms? These terms are often overlooked by small businesses, but they are vital for an invoice for customs clearance. They tell the customs officer who is paying for the duties and where the seller’s responsibility ends. Common terms include:

- EXW (Ex Works): The buyer handles everything from the seller’s door.

- FOB (Free on Board): The seller gets the goods to the ship, and then the buyer takes over.

- DDP (Delivered Duty Paid): The seller is responsible for all costs, including import duties.

If you list DDP on your invoice, customs knows to bill the shipping company (who then bills you). If you list EXW, they will look to the recipient for payment. Mislabeling this can lead to your customer being hit with unexpected bills at their doorstep, which is a terrible experience. Let us cut to what matters: always clarify the Incoterms with your buyer before you draft the invoice.

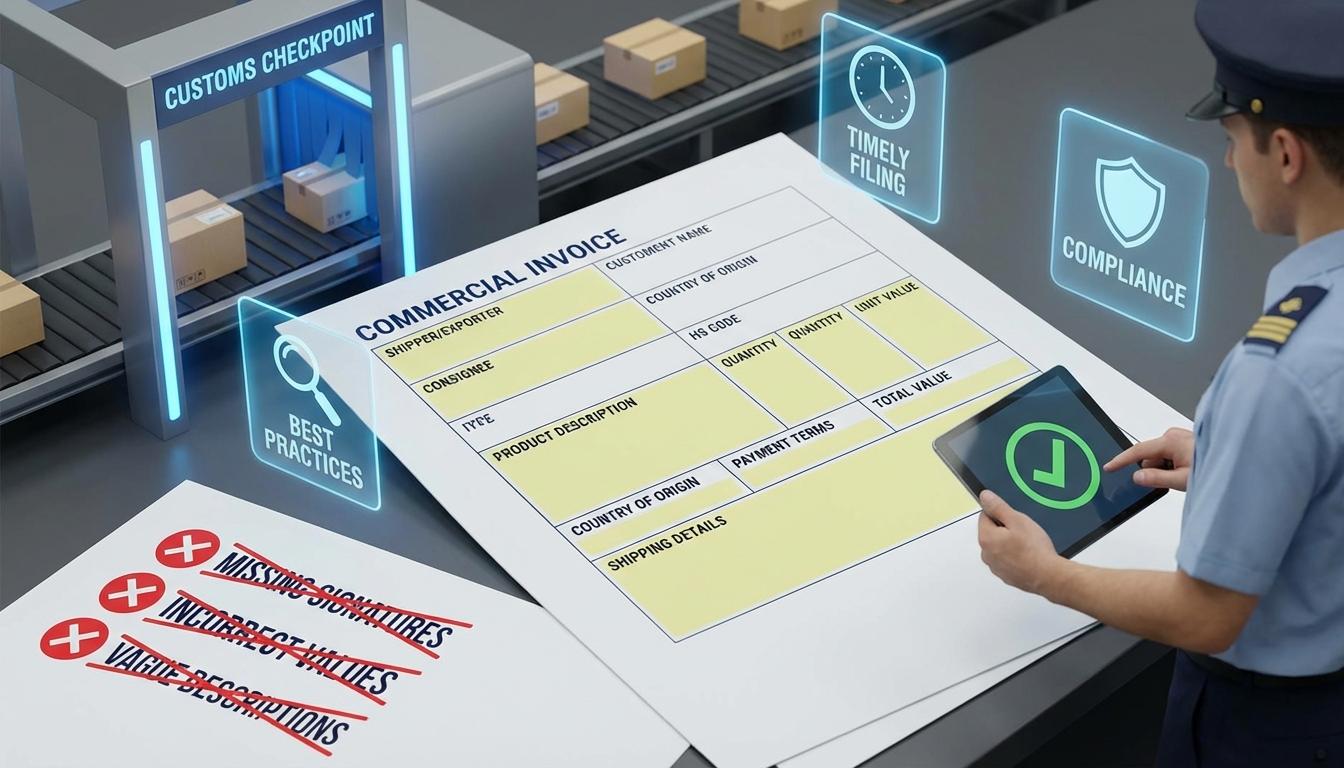

Best Practices and Common Errors to Avoid

We have seen these mistakes happen constantly, so let us settle how to avoid them. Even if you have all the right fields, the way you present the document matters. Customs is a bureaucratic process, and bureaucrats love consistency.

First, always include at least three copies of the commercial invoice. Place one inside the package and attach two to the outside in a clear “packing list understudy” pouch. This allows agents to inspect the paperwork without breaking the seal on your box. Second, ensure that an authorized representative of your company signs the document. A signature certifies that the information is true and correct, and in many countries, an unsigned invoice is legally invalid.

Another common error is undervaluation. It might be tempting to list a $1,000 item as $100 to save your customer some money on taxes, but this is illegal. Customs authorities have extensive databases of what goods should cost. If your value looks suspiciously low, they will flag it, and you could face heavy fines or even a permanent ban on exporting. As noted by U.S. Customs and Border Protection, providing an accurate value is a legal requirement for entry.

Quick Reference: Commercial Invoice Essentials

- Required for: All international shipments of goods (not for documents).

- Core Fields: Shipper/Consignee, HS Code, Value, Currency, Origin, Incoterms.

- Description Style: Technical and specific (Materials + Use).

- Copies: Three copies (one inside, two outside).

- Format: Must be in English (or the language of the destination country).

- Signature: Required to certify accuracy.

Common Questions About Commercial Invoices

Do I need a commercial invoice for every international shipment?

Yes, if you are shipping physical goods. The only exception is usually “pure documents,” which include things like letters, manuscripts, or business contracts that have no commercial value. If it is a product, you need the invoice.

What happens if my commercial invoice is incorrect?

The direct answer is that your shipment will be delayed. Customs will hold the package and contact the carrier. You may be charged “demurrage” (storage fees) while the issue is resolved, and you could be fined for providing false information.

Does a commercial invoice need to be on company letterhead?

While not strictly a legal requirement in every country, it is highly recommended. Using a professional shipping invoice template on letterhead adds credibility and makes it easier for customs agents to verify the legitimacy of your business.

Can I use a proforma invoice for customs clearance?

Not quite. While some countries allow it for low-value shipments or samples, the vast majority of customs authorities require a final commercial invoice to process duties and taxes correctly. Your best move is to always provide the final version.

Moving Forward with Your Shipment

Handling a commercial invoice for shipping does not have to be overwhelming if you focus on the details. The real question is whether your documentation is clear enough for a stranger in a customs office to understand exactly what you are sending. By being specific with your descriptions, accurate with your valuations, and consistent with your paperwork, you significantly reduce the risk of your goods getting stuck.

Your next step is to gather your HS codes and confirm your Incoterms with your buyer. Once you have those, you can fill out your invoice with confidence. Remember that this document is the primary evidence for your transaction, so take the extra five minutes to double-check every field. For more help with the rest of your shipping paperwork, refer back to our guide on the international shipping documents checklist to make sure you have everything else in order. Get your paperwork right, and the rest of the shipping process will follow suit.