Understanding Certificate of Origin Types and When to Use Each

Shipping goods across borders often feels like navigating a maze of paperwork. One wrong turn or a missing signature can lead to expensive delays at the port. If you are trying to understand the different certificate of origin types, you are likely looking for a way to ensure your cargo clears customs without a hitch. This document is essentially the passport for your products, certifying exactly where they were grown, manufactured, or produced. While the concept sounds simple, the specific type of certificate you choose can determine whether you pay the full tariff rate or enjoy significant duty discounts.

You probably already know that international trade requires a mountain of forms. However, the country of origin certificate is one of the most critical pieces because it dictates the commercial nationality of your goods. We are here to provide the detailed, specific breakdown you have been searching for to help you choose the right form for your shipment. If you are looking for a broader look at how this fits into your overall workflow, you might find our international shipping documents checklist a helpful place to start after you finish this deep dive.

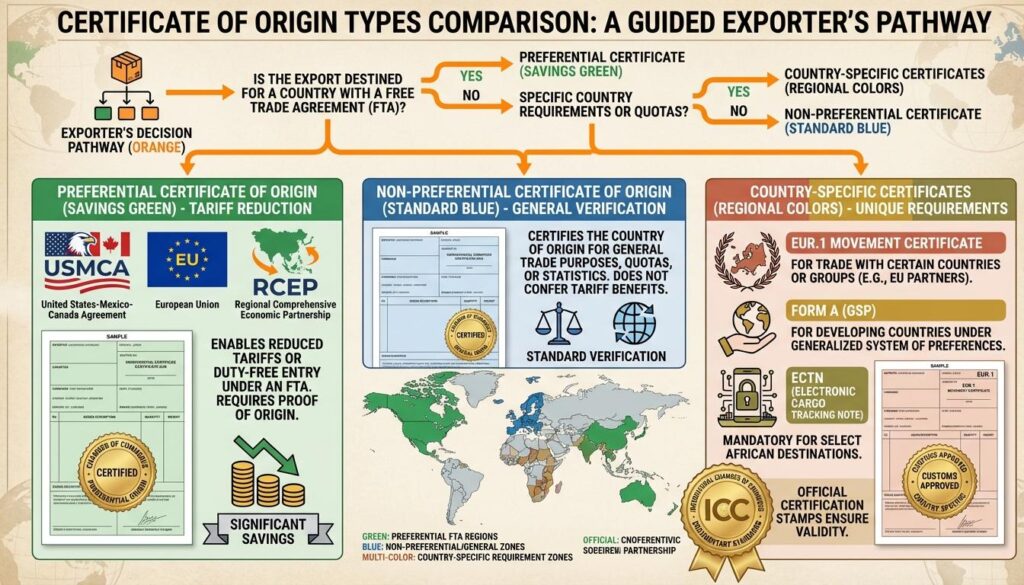

The Fundamental Split: Preferential vs. Non-Preferential

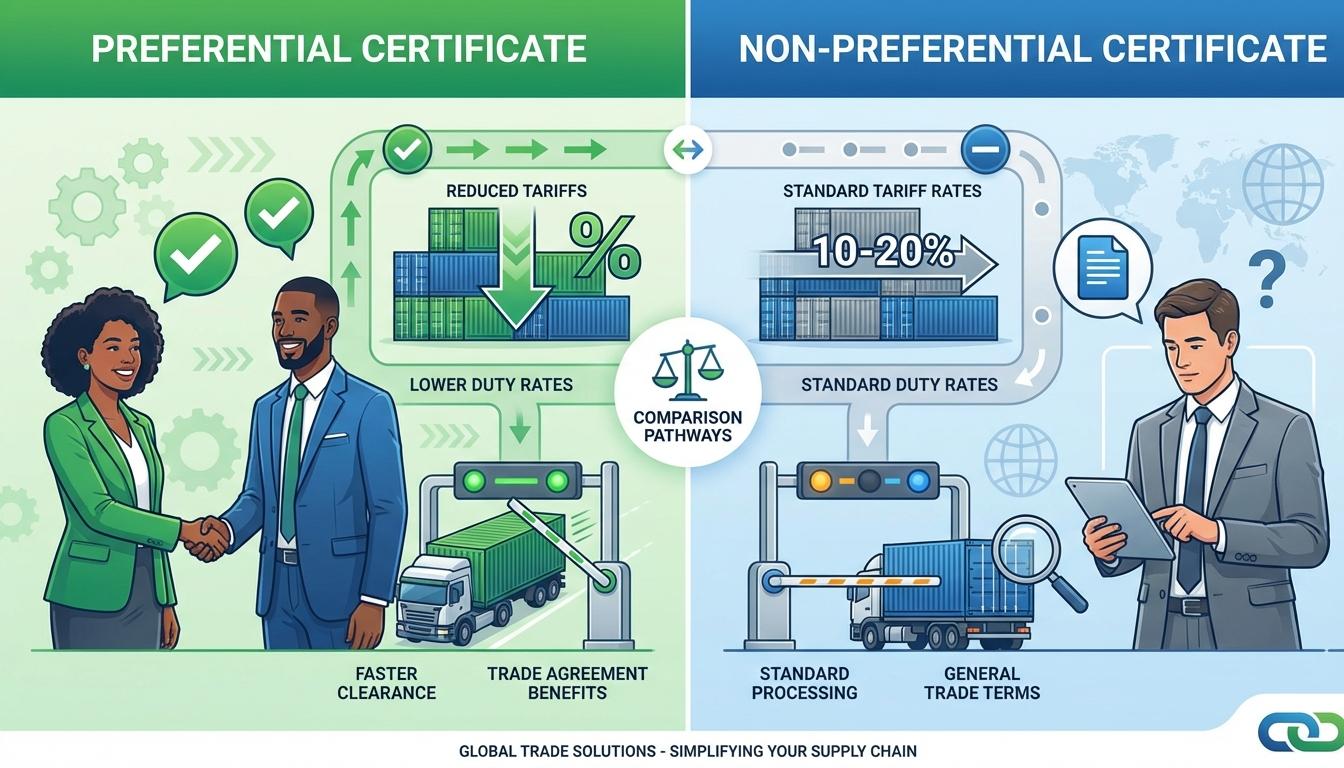

When it comes to certificate of origin types, the first thing we need to clarify is the difference between preferential and non-preferential documents. This is the detail that changes everything for your bottom line. Let us get into the details of why this distinction matters so much.

A non-preferential certificate is the most common version. It simply states where the goods came from without asking for any special treatment. Customs authorities use these to enforce trade embargoes, apply standard tariffs, or collect statistics. In many cases, you might only need one because your buyer or their bank requires it as part of a letter of credit. It proves the goods are not from a restricted country, but it does not provide any duty relief.

On the other hand, a preferential certificate of origin is your ticket to lower taxes. These are used when the exporting and importing countries have a Free Trade Agreement (FTA) in place. If your goods meet the specific rules of origin outlined in that agreement, this document allows you to claim a reduced or even zero percent tariff rate. The catch is that the rules for preferential origin documentation are much stricter. You have to prove that the goods were not just shipped from a country, but genuinely produced or substantially transformed there.

Your best move here is to check the trade agreement between your country and your customer’s country. If an agreement exists, you should almost always aim for a preferential certificate. Why pay more in duties than you absolutely have to?

Non-Preferential Origin Documentation and General Compliance

Even if there is no trade agreement in place, you often still need to provide proof of origin. This is where non-preferential origin documentation comes into play. Here is the specific situation where this applies: the goods are subject to standard “Most Favored Nation” tariff rates.

Customs authorities use these certificates for several regulatory reasons. They need to know the origin to apply anti-dumping duties or to ensure the goods are not part of a quota system. For example, if a country has a limit on how much steel it imports from a specific region, they use the CO document to track those numbers accurately. It is also a tool for trade statistics, helping governments understand their trade balances with the rest of the world.

In practice, this means you should verify your requirements with the importer early in the process. Sometimes a simple statement on your commercial invoice shipping guide is enough, but many countries still require a formal document stamped by a Chamber of Commerce. The key difference is that non-preferential certificates are generally easier to obtain because they do not require the deep dive into manufacturing components that preferential ones do.

Understanding Specific Preferential Certificate Types

If you are eligible for trade benefits, you will likely encounter specific forms based on the region you are trading with. Let us look at this closely. Each agreement has its own specific paperwork, and using the wrong one can lead to a rejected claim. Here are the most common types you will see in global trade.

The EUR.1 and EUR-MED Movement Certificates

If you are trading with the European Union or its partner countries, the EUR.1 is the gold standard. This form allows goods to circulate with preferential duty rates under various EU trade agreements. There is also the EUR-MED, which is used when goods involve materials from multiple countries within the Pan-Euro-Mediterranean zone. These forms are highly regulated and usually require a formal application to customs authorities or an authorized body.

Form A (Generalized System of Preferences)

Form A is specifically used for the Generalized System of Preferences (GSP). This is a program where developed countries allow duty-free or low-duty imports from developing nations to support their economic growth. If you are importing handmade textiles from a developing country into the United States or Europe, Form A is often the specific answer to lowering your costs.

Form E (ASEAN-China FTA)

For those operating in Southeast Asia, Form E is a common requirement. It covers trade between ASEAN member states and China. To use this, the goods must meet specific rules of origin, such as containing at least 40 percent regional value content. This is a great example of where the details matter. If your product is 35 percent regional and 65 percent from elsewhere, a Form E will be rejected, and you will pay full duties.

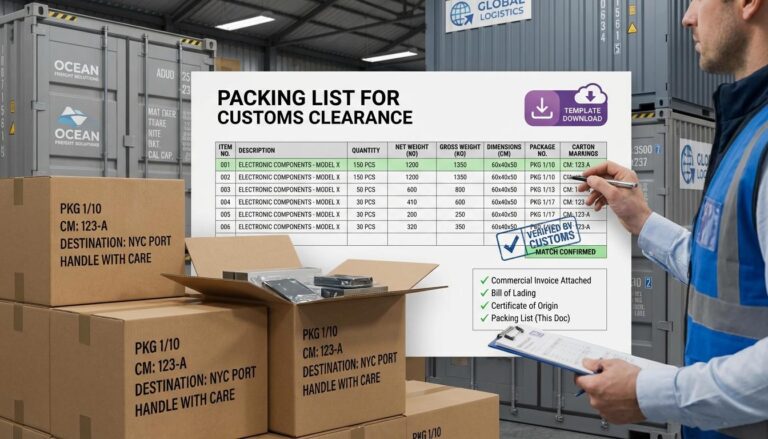

USMCA and Modern Origin Declarations

The USMCA (which replaced NAFTA) changed the game for North American trade. Instead of a rigid, government-provided form, it allows for an origin declaration. This is a statement that can be placed directly on an invoice or a separate document, as long as it contains the nine required data elements. This shift toward self-certification makes life easier for exporters but puts the burden of proof squarely on your shoulders. You must keep records for at least five years to prove your origin claim was accurate. To keep your logistics organized during this process, many exporters find it useful to keep their documentation bundled with a clear packing list customs template for easy auditing.

The Rise of Electronic Certificates of Origin (eCO)

The days of waiting for a physical stamp from a local Chamber of Commerce are slowly fading. We have seen this question come up constantly: do I really need a paper document? The answer is increasingly no. Electronic Certificates of Origin, or eCOs, are becoming the standard for modern exporters.

These digital documents are issued online through platforms like essCert or SWIFTcert. They carry the same legal weight as paper versions but offer several advantages. For one, they are much harder to forge. Most eCOs include a digital watermark and a QR code that customs officers can scan to verify the document’s authenticity against a global database. According to the International Chamber of Commerce (ICC), the adoption of digital standards is crucial for reducing fraud and speeding up the global supply chain.

So what does this mean for you? If your local Chamber of Commerce offers eCO services, that is usually your best move. You can save days in transit time by emailing a digital file rather than couriering a paper document across the world. Just ensure that the importing country accepts digital versions, as some more traditional customs offices still demand “wet ink” signatures and physical stamps.

What Information is Required on a CO Document?

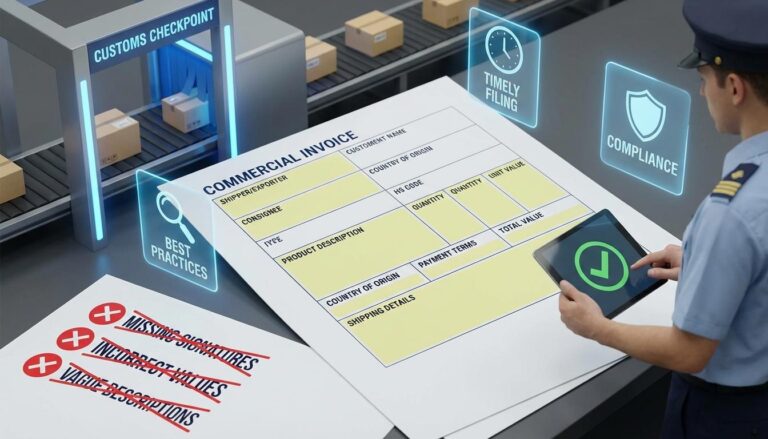

Regardless of the type, almost every CO document requires a set of core details. This is exactly what you need to know before you start the application process. Missing one piece of data can invalidate the entire document.

- Exporter and Consignee Information: Full names and addresses are mandatory. These must match your other shipping documents exactly.

- Description of Goods: This should be clear and concise. Avoid vague terms like “parts” or “merchandise.”

- HS Codes: The Harmonized System code is the language of global trade. You usually need the first six digits at a minimum.

- Country of Origin: This is the star of the show. You must clearly state where the goods were produced.

- Weight and Quantity: Both gross and net weights are typically required, along with the number of packages.

- Transport Details: The name of the vessel, flight number, or trucking company, along with the port of loading and discharge.

The practical takeaway is that consistency is king. If your certificate says “Made in Vietnam” but your shipping crates are marked “Made in China,” you are going to have a very long and expensive conversation with a customs official. Always double-check that your packaging, invoices, and certificates all tell the same story.

How to Apply for a Certificate of Origin

Now for the part you actually came here for: the process of actually getting the document. Most exporters do not realize that you cannot just print a CO on your own letterhead and call it a day (unless you are under an agreement like USMCA that allows for self-certification). For most certificate of origin types, you need a third party to verify your claim.

- Determine your needs: Identify if you need a preferential or non-preferential certificate based on the destination and any applicable trade agreements.

- Gather your evidence: You will need your commercial invoice, a packing list, and often a “manufacturer’s affidavit” if you did not make the goods yourself. This proves to the Chamber that you are not just guessing about the origin.

- Find an issuing body: In the United States, this is typically a local Chamber of Commerce. In other countries, it might be a government agency like the International Trade Administration or a specific export council.

- Submit your application: You can do this through an online portal for an eCO or by visiting the office in person.

- Pay the fee: Chambers of Commerce charge for this service. Fees can range from $25 to $100 depending on your membership status and the urgency of the request.

- Receive and send: Once stamped and signed, the certificate must be sent to the importer to clear the goods.

The action item here is simple: do not wait until the cargo is on the ship to start this process. We recommend applying for your CO at least two to three days before your shipment departs. This gives you a buffer in case the Chamber asks for more evidence regarding your origin claim.

Quick Reference: Certificate of Origin Types at a Glance

- Non-Preferential CO: Used for general trade, statistics, and embargo enforcement. No duty benefits.

- EUR.1: Essential for trade with the EU and its specific FTA partners.

- Form A: Used for the GSP program to help developing nations export with lower duties.

- USMCA Certification: A self-certified declaration for trade between the US, Mexico, and Canada.

- eCO (Electronic): A digital version of a CO that allows for faster processing and better security.

- Origin Declaration: A simple statement on an invoice used in some modern free trade agreements.

Common Questions About Certificate of Origin Types

Can I use a Certificate of Origin for multiple shipments?

The short version is no, generally not. Most COs are transaction-specific, meaning they apply to one specific invoice and one specific shipment. However, some agreements like the USMCA allow for a “blanket certificate” that can cover a range of identical goods for up to one year. You must check the specific rules of the trade agreement you are using.

What happens if I use the wrong HS code on my certificate?

This is one of those areas where getting it right makes a real difference. If the HS code on your CO does not match the code on your customs entry, the certificate may be considered invalid. This could result in the loss of preferential duty rates and potentially a fine for misdeclaration. Always verify your codes before submitting your application.

Who is responsible for paying for the Certificate of Origin?

The direct answer is that it depends on your “Incoterms” or your sales agreement. Typically, the exporter is responsible for obtaining and paying for the CO because they are the only ones with the records to prove the origin. However, these costs are often passed on to the buyer as part of the shipping and handling fees.

Do I need a Certificate of Origin for personal shipments?

Usually, no. Most customs authorities have a “de minimis” value or a threshold for personal goods where a formal CO is not required. However, if you are shipping high-value items or large quantities of goods for personal use, you might still be asked for proof of origin to ensure you are not circumventing commercial import rules.

Moving Forward with Your Documentation

Understanding the different certificate of origin types is about more than just filling out a form. It is about protecting your business from unnecessary costs and legal headaches. Whether you are using a standard non-preferential certificate for a shipment to the Middle East or a complex EUR.1 for a client in Europe, the details matter. There is a reason this specific aspect confuses people, the rules are constantly changing as new trade agreements are signed and old ones are updated.

Here is the practical takeaway. Start by identifying if a trade agreement exists. If it does, do the work to qualify for a preferential certificate. The savings on duties often far outweigh the time spent on the paperwork. If no agreement exists, stick to a non-preferential certificate and ensure your data is consistent across all your documents. Your next step is to contact your local Chamber of Commerce to see if they offer electronic filing. Embracing digital tools will make your export process faster and more secure. Stay focused on the details, and you will find that international trade becomes a lot less intimidating.