The Bullwhip Effect: Why It Happens and How to Stop It

Ever wondered why a small 5 percent uptick in retail sales suddenly turns into a massive production crisis for a manufacturer three states away? You might be seeing the bullwhip effect in supply chain operations firsthand. It is a frustrating phenomenon where minor ripples in customer demand create massive waves of inventory chaos as they move upstream. If you feel like your warehouse is either overflowing with stock or completely empty, you are not alone. Most supply chain professionals struggle with this exact type of demand amplification at some point in their careers. We are going to get straight into what works, what does not, and exactly what you should do to stabilize your operations.

If you are reading this, you probably already know the basics of how orders move through a system. You are looking for the specific answer to why those orders become so distorted and how to fix the mess. This is the detailed breakdown you have been searching for. We will look at the mechanics of supply chain distortion and provide a step-by-step approach to regaining control. For a complete overview of broader logistics planning, check out our main guide on supply chain strategy framework. Now, let us get into the details.

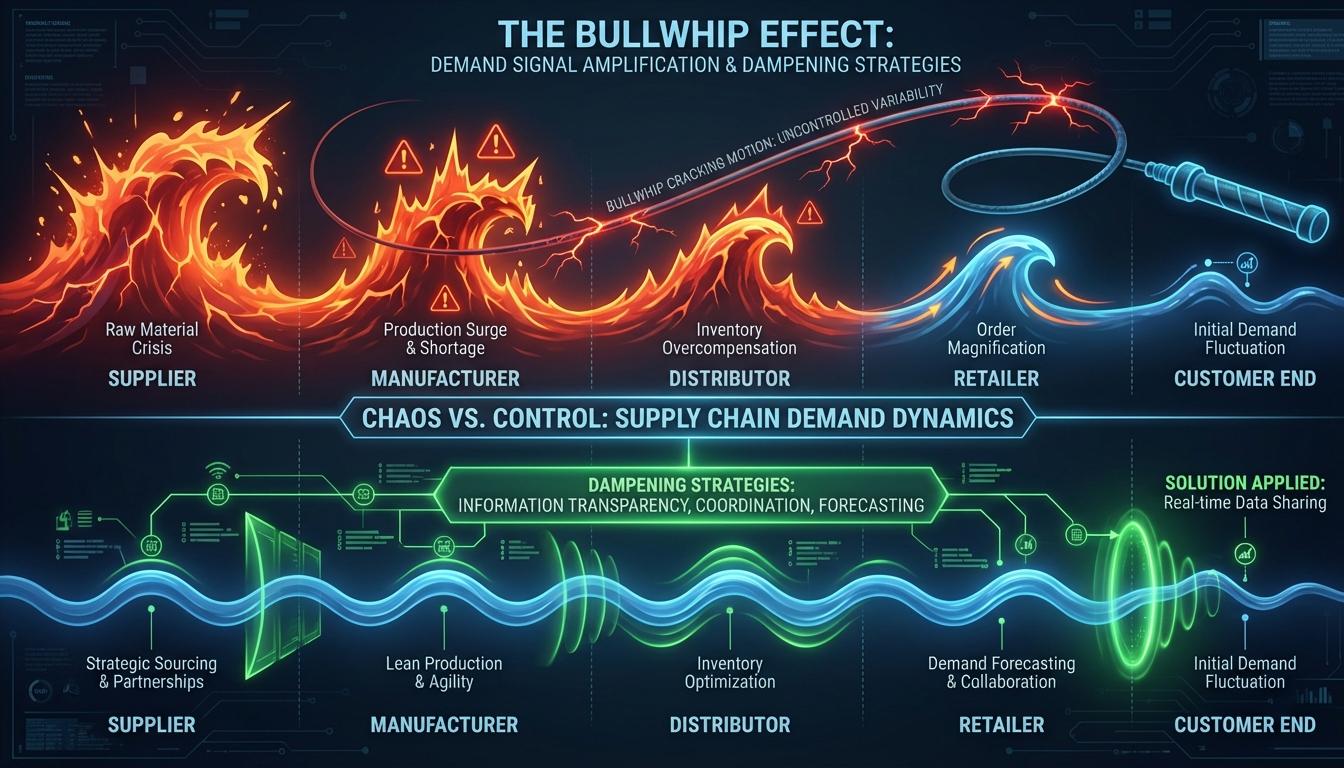

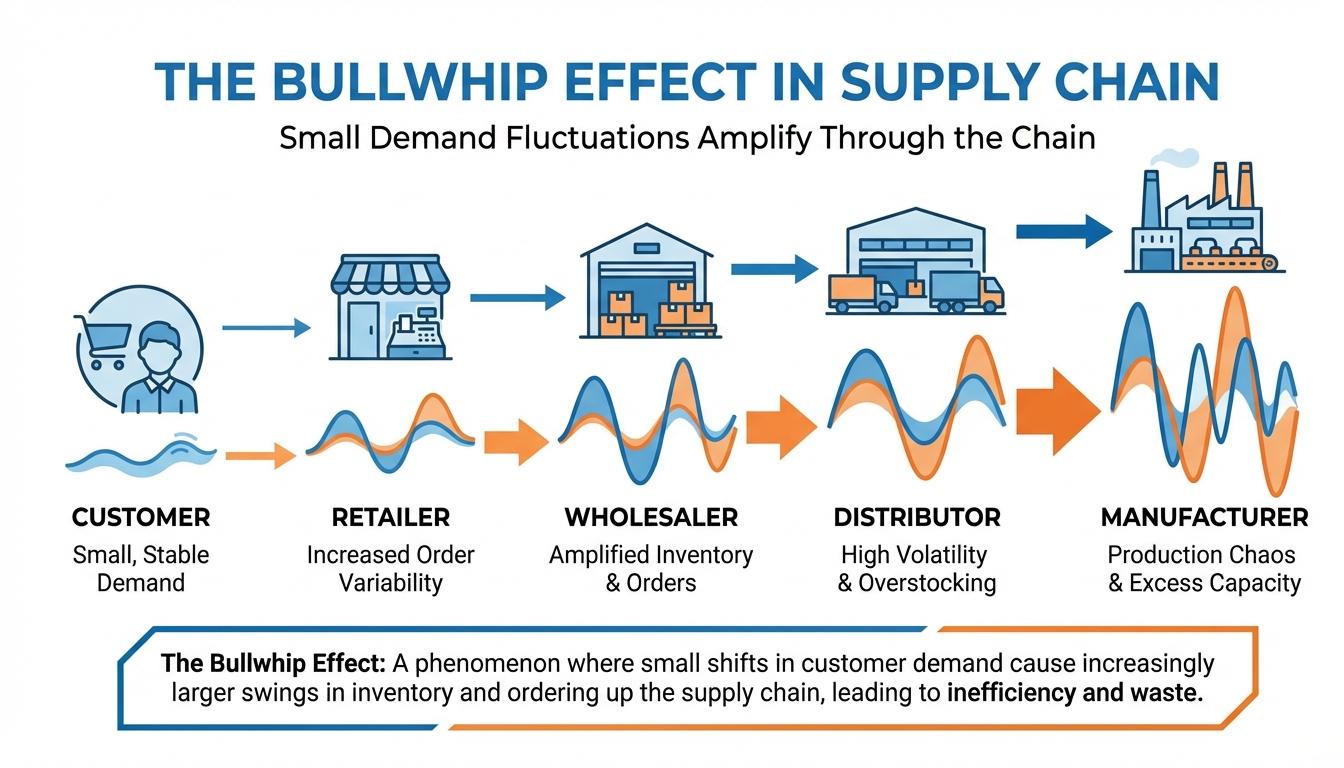

What the Bullwhip Effect Actually Looks Like

When we talk about the bullwhip effect, we are describing a specific type of demand signal distortion. Think of a literal bullwhip. A small flick of the wrist at one end creates a massive, snapping motion at the other. In a supply chain, that “wrist flick” is the customer making a purchase. The “snap” is the raw material supplier trying to fulfill an order that is ten times larger than what was actually sold. This happens because each person in the chain adds their own buffer, making order variability much higher than actual demand variability.

Let us look at this closely with a classic example. Back in the 1990s, Procter and Gamble noticed something strange with their Pampers brand. While babies use diapers at a very steady and predictable rate, the orders from distributors were swinging wildly. This was the bullwhip effect in action. Retailers saw a small spike, ordered extra for safety, and the wholesaler then doubled that order to be safe themselves. By the time the signal reached the factory, the demand looked like a massive surge that did not exist in the real world.

A more recent case is the COVID 19 toilet paper shortage. When shoppers started buying extra packs out of fear, retailers placed massive orders. Manufacturers responded by ramping up production to the absolute limit. However, the actual consumption of toilet paper had not changed. People were just stocking up. Once those home cupboards were full, demand plummeted, leaving the entire supply chain with excess inventory and misaligned capacity. This is why getting the signal right matters so much.

The practical takeaway is simple. If you only look at the orders coming from your immediate customer, you are looking at a distorted mirror. You are seeing their fears and their safety buffers, not the actual market demand. To fix this, we have to understand what causes these distortions to grow so large.

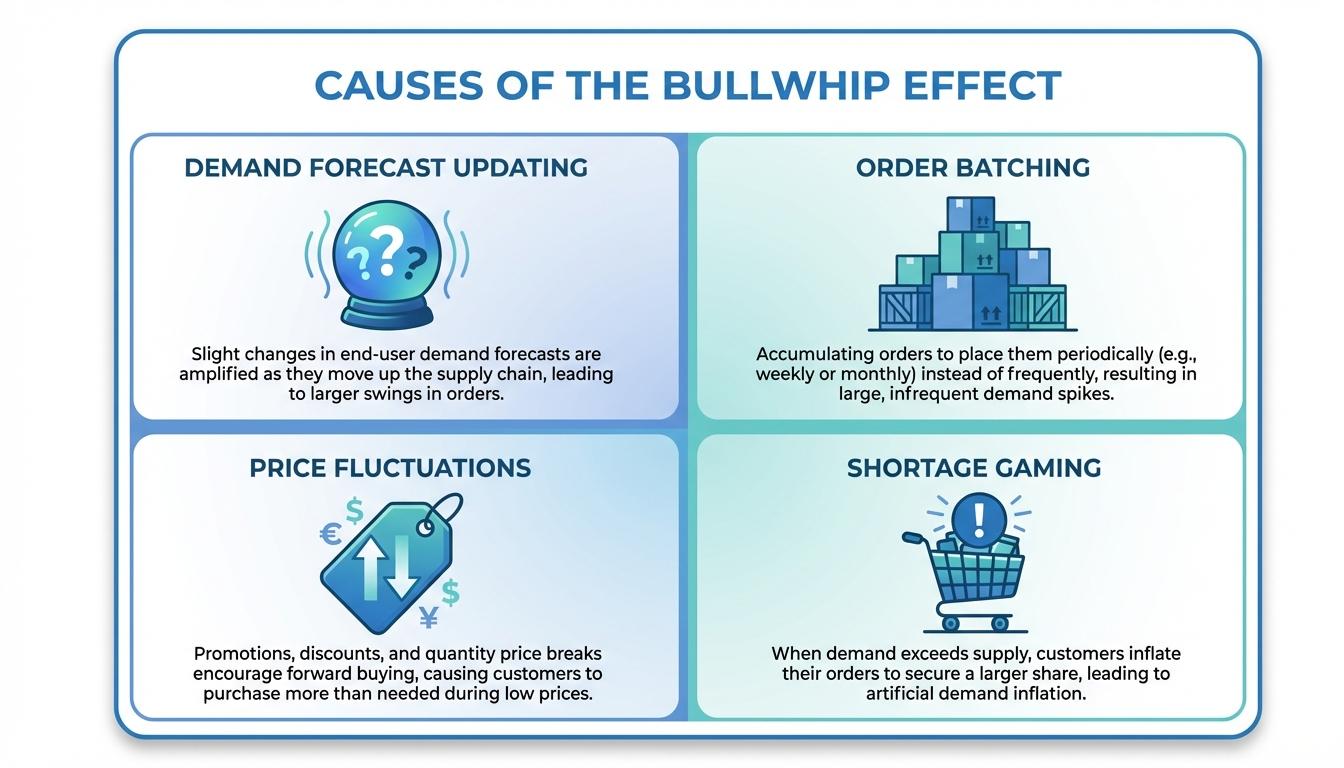

The Core Causes of Supply Chain Distortion

Why does this keep happening? It is rarely the result of one bad decision. Instead, it is a combination of several structural and behavioral factors that compound each other. Here is the specific answer to what is driving that volatility in your warehouse.

Demand Forecast Updating and Just in Case Thinking

Most companies forecast future needs based on the orders they receive from the node directly below them. If a retailer orders 100 units this month and 120 next month, the wholesaler assumes demand is growing by 20 percent. They do not just order 120. They order 140 to build a safety stock buffer. This is often called just in case behavior. When every person in a multi echelon supply chain adds their own safety factor, the original demand signal is completely lost. According to research from ASCM, this lack of visibility is the primary driver of demand amplification.

The Problem with Order Batching

We all like to save money on shipping. This leads many managers to use order batching. Instead of ordering five items every day, they wait and order 150 items once a month. This makes sense for transportation costs but it is a disaster for the supplier. The supplier sees three weeks of zero demand followed by a massive “spike” that they have to scramble to fill. They might interpret this as a permanent increase in demand and ramp up production unnecessarily.

Price Fluctuations and Forward Buying

This is one of those areas where getting it right makes a real difference. When a company runs a major promotion or a temporary discount, customers often engage in forward buying. They buy six months worth of product now because it is cheap. The manufacturer sees a record breaking sales month and thinks the brand is exploding. In reality, they have just moved future sales to the present. Once the promotion ends, sales will crash because everyone already has stock. This creates artificial demand surges that confuse everyone upstream.

Shortage Gaming and Allocation Rules

This is the specific situation where human behavior makes the problem worse. When a product is in short supply, suppliers often use allocation. If you order 100 and they only have 50, they give you 50. Smart buyers catch on and start “shortage gaming.” They will order 200 units just to ensure they get the 100 they actually need. This creates a massive, fake demand signal that tells the manufacturer to build even more capacity for a demand that will vanish the moment the shortage ends.

Why Demand Variability Costs You Money

The impacts of the bullwhip effect are not just annoying. They are expensive. When we see demand variability increase, we see costs rise across every department. Here is what that actually looks like on your balance sheet.

- Excess Inventory and Carrying Costs: Because everyone is over ordering for safety, you end up with too much stock. This ties up your capital and takes up expensive warehouse space. For perishable or seasonal goods, this often leads to total waste when items expire.

- Unstable Production Schedules: Manufacturers hate surprises. When orders swing wildly, factories have to pay for overtime one week and then let workers sit idle the next. This constant shifting reduces efficiency and raises the cost per unit.

- Increased Logistics Workload: Managing a “hockey stick” sales pattern, where most orders come at the end of the month, puts massive strain on your transportation and warehouse teams. You end up paying premium rates for last minute freight just to keep up with perceived demand.

- Service Failures: Paradoxically, the bullwhip effect often leads to stockouts. Because the system is so volatile, inventory is rarely in the right place at the right time. You might have thousands of units in a regional hub while the local retail shelf is empty.

The real question is how much of your current “busy work” is actually just responding to these artificial swings. If you are constantly chasing backlogged orders or trying to find space for excess stock, you are likely a victim of supply chain distortion. To get a better handle on your performance metrics, you should evaluate your current supply chain KPIs to see where the variability is hiding.

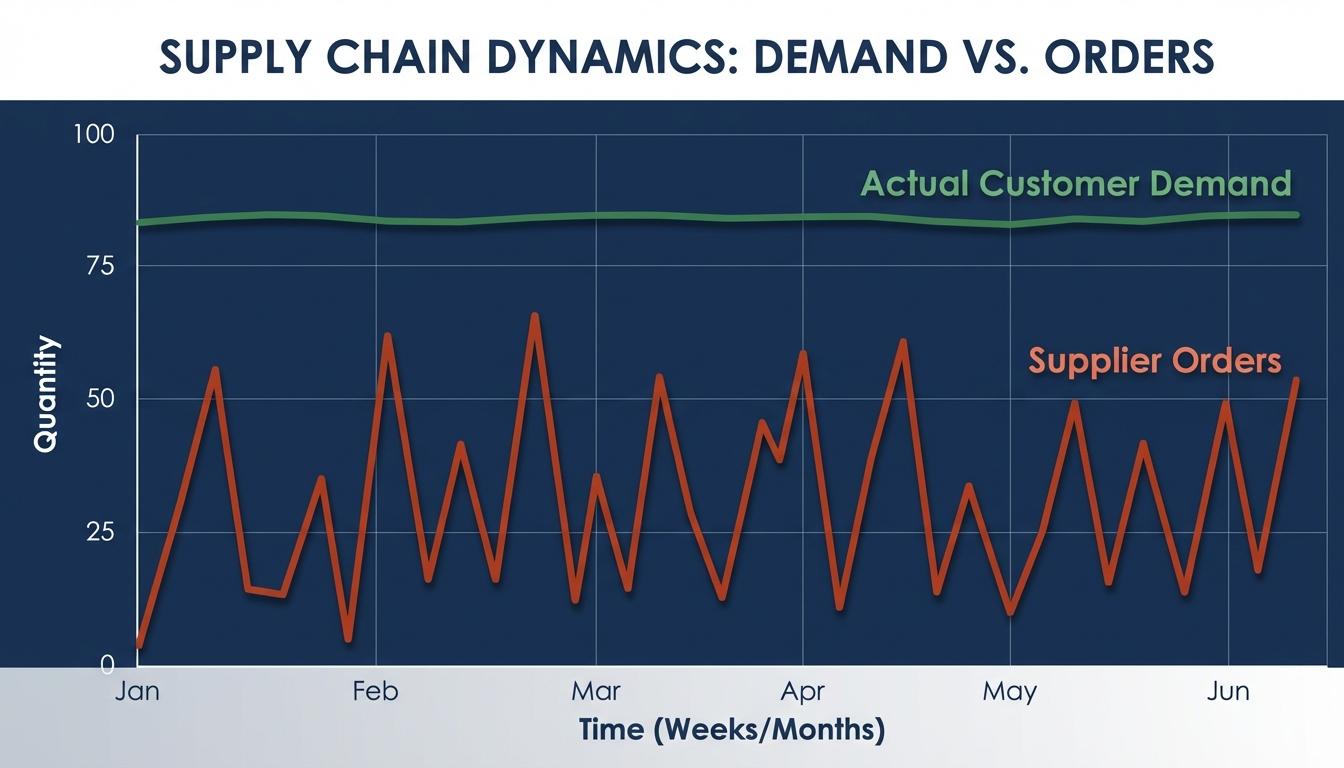

How to Measure the Bullwhip Effect

You cannot fix what you cannot measure. When it comes to demand amplification, we use a specific metric called the Coefficient of Variation, or CoV. This is the ratio of the standard deviation of demand to the mean demand. It tells us how much “noise” is in your data compared to the actual volume.

The math is straightforward. If you want to see if the bullwhip effect is hitting your operations, compare the CoV of your orders to your supplier against the CoV of the sales to your customers. If your outgoing orders are significantly more volatile than your incoming sales, you have a bullwhip problem. This is the detail that changes everything for many planners. Once they see the numbers, they realize the “unpredictable market” is actually a problem they are creating internally through their ordering habits.

Your best move here is to map this across several stages. If the CoV increases at every step as you move from the retailer to the manufacturer, you have a classic bullwhip pattern. This measurement gives you the evidence you need to convince leadership that changing the ordering process is more important than just “working harder.”

Specific Strategies to Stop the Whip

So what should you do right now? We need to move from reactive ordering to proactive collaboration. Here is the step-by-step breakdown of how to stabilize your supply chain.

1. Share Point of Sale (POS) Data

The direct answer to supply chain distortion is visibility. If the manufacturer can see exactly what is being sold at the cash register, they do not have to guess based on the wholesaler’s erratic orders. Sharing POS data allows everyone in the chain to work from a single version of the truth. This is a core part of effective supply chain visibility strategies that we recommend for any complex network.

2. Reduce Lead Times

Long lead times are like fuel for the bullwhip effect. If it takes six weeks to get a product, you have to forecast six weeks into the future. That is hard to do accurately, so you order extra “just in case.” If you can reduce that lead time to three days, your forecast becomes much more accurate and your safety stock requirements drop. Your next step is to look for bottlenecks in your transportation and production that are artificially inflating your wait times.

3. Move to Smaller, Frequent Batches

We have seen this work time and again. Instead of ordering one giant container once a month, try ordering smaller amounts every week. This smooths out the demand signal and makes life much easier for your suppliers. You might pay slightly more in transportation per unit, but you will save significantly more by reducing inventory holding costs and avoiding emergency “rush” shipments.

4. Stabilize Your Pricing

Stop the constant cycle of deep discounts followed by price hikes. Every time you run a massive sale, you are intentionally creating a bullwhip effect. Moving toward Every Day Low Pricing (EDLP) creates a much smoother demand pattern. This allows your production and logistics teams to plan for steady volume rather than preparing for “war” every time the marketing department runs a promotion.

5. Align Your Incentives

Here is the thing most people miss. Often, your own sales team is causing the bullwhip. If your sales reps have quarterly targets, they will push customers to buy extra at the end of the month just to hit their bonus. This creates a massive spike followed by a slump. Aligning incentives with actual consumption rather than just “shipping volume” is the action item here.

Quick Reference: Bullwhip Mitigation at a Glance

- The Goal: Match supply to actual customer consumption, not intermediate orders.

- Main Metric: Coefficient of Variation (CoV) comparison between echelons.

- Top Solution: Implementing Vendor Managed Inventory (VMI) or Collaborative Planning, Forecasting, and Replenishment (CPFR).

- Lead Time: Shorter lead times always lead to a smaller bullwhip effect.

- Order Frequency: High frequency, low volume orders are superior to low frequency, high volume batches.

- Pricing Strategy: Consistent pricing is better for supply chain health than aggressive promotions.

Common Questions About the Bullwhip Effect

Is the bullwhip effect just another name for bad forecasting?

The answer is no. Even with “perfect” forecasting at each stage, the bullwhip effect can still happen because of lead times and order batching. It is a structural problem of the supply chain itself, not just an error in math. You can be a great forecaster and still suffer from demand amplification if your ordering policies are rigid.

Does the bullwhip effect only happen in large companies?

Not quite. While large companies like P&G made it famous, small businesses are often more vulnerable to it. A small business with a single supplier and long lead times can be completely wiped out by a sudden surge followed by a demand trough. The principles of reducing batch sizes and sharing data apply to everyone.

How does Vendor Managed Inventory (VMI) help?

VMI is one of the most effective tools we have. In this model, the supplier takes over the responsibility of managing the inventory at the customer’s location. Because the supplier sees the actual stock levels and usage, they can ship exactly what is needed without waiting for a distorted order signal from the customer.

Can technology alone fix the bullwhip effect?

Technology is a tool, but it is not a cure. You can have the best software in the world, but if your procurement team is still incentivized to buy in massive batches for discounts, the bullwhip will remain. Fixing the bullwhip requires a change in both data sharing and business policy. According to research published by Foods Connected, behavioral changes are just as important as digital ones.

Now you have the specific answer you came for. The key point is that the bullwhip effect is an avoidable result of misaligned information and incentives. It is about the “noise” in your system, not just the fluctuations of the market. By focusing on visibility, shortening your lead times, and smoothing out your order patterns, you can stop the constant cycle of shortages and surpluses.