Supplier Discovery Methods: Finding the Right Partners

Looking for the exact breakdown of supplier discovery methods? You have come to the right place. While general procurement guides cover the basics of buying, you need the specific details that actually help you identify the best partners before the bidding even begins. We are going to get straight into what works, what does not, and exactly what you should do to build a resilient supply chain. Let us get specific.

If you are reading this, you probably already know that finding the right partner is not just about looking at a price tag. You are looking for the detailed breakdown of how to find new suppliers who can actually deliver on their promises. This process, known as vendor discovery, is the exploratory “hunting” phase that sets the stage for everything that follows. For a complete overview of how this fits into the bigger picture, check out our main guide on the strategic sourcing process phases. Now, let us look at the methods that actually move the needle.

The Direct Answer: What are Supplier Discovery Methods?

Supplier discovery methods are the specific techniques used to identify and shortlist potential new vendors. These methods are distinct from routine sourcing because they focus on finding partners who are not yet in your internal database. The short version is that discovery is about exploration, and here is why that matters. If you only buy from people you already know, you miss out on innovation, better pricing, and the diversity required to mitigate risk. This is exactly what you need to know to find those hidden gems.

We see discovery as the foundation of quality. If your discovery methods are weak, your final selection will be weak. It does not matter how good your negotiation skills are if you are negotiating with the wrong people. Here is the specific situation where this applies. When you enter a new market, launch a new product, or need to diversify your supply base due to global disruptions, discovery becomes your most important task. Your best move here is to use a mix of digital and traditional methods to ensure you are not leaving any stone unturned.

The practical takeaway is simple. You are building a pipeline. Just like a sales team builds a pipeline of leads, a procurement team builds a pipeline of qualified candidates. This phase precedes evaluation, contracting, and management. It is the wide end of the funnel where you gather as much intelligence as possible about the market landscape.

Digital Sourcing Tools and AI Databases

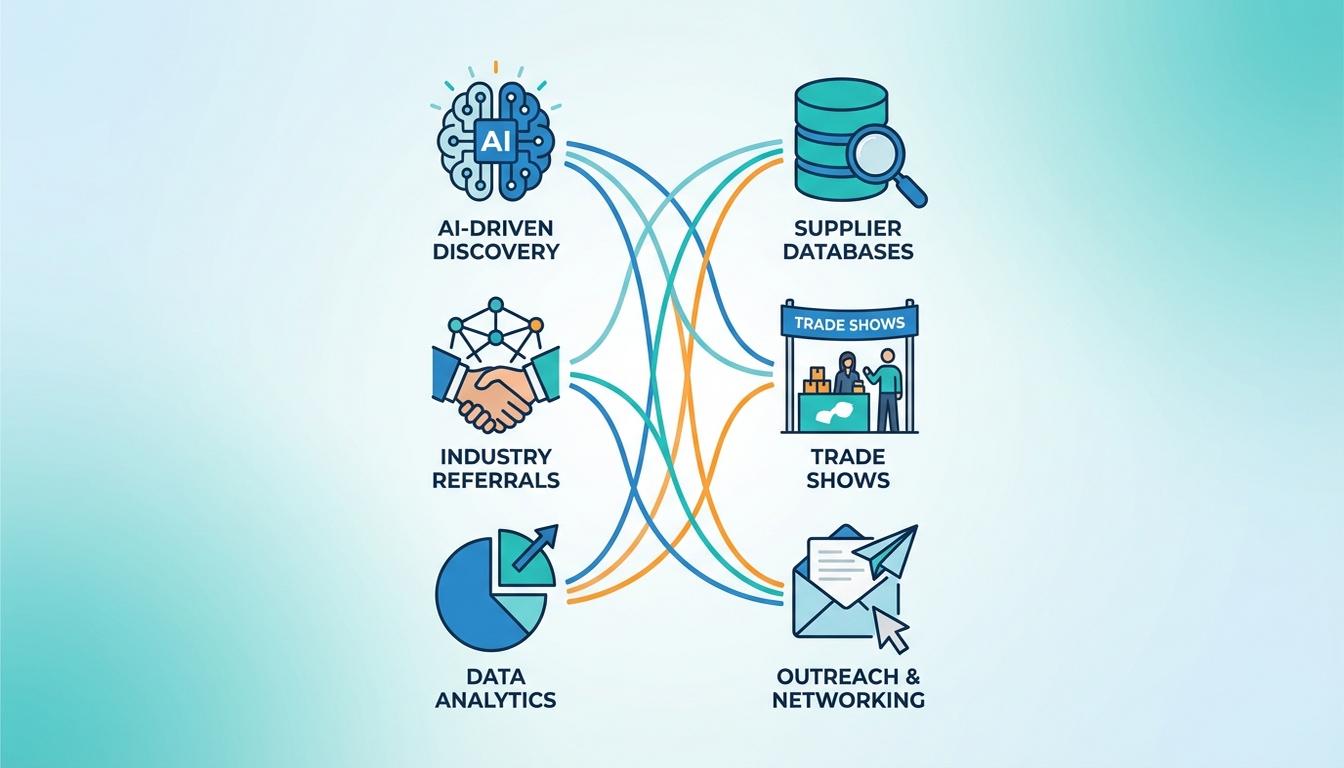

When it comes to modern supplier discovery, digital tools are the undisputed heavyweights. Let us get into the details of why these platforms have changed the game. In the past, a supplier search involved heavy manuals and dozens of phone calls. Today, AI-powered search engines and massive supplier databases allow us to filter thousands of companies in seconds. These tools aggregate data on company size, financial health, location, and even environmental compliance.

Here is what that actually looks like in practice. Platforms like Veridion or Zapro use machine learning to scan the global market and provide risk scores for potential partners. This is the detail that changes everything. Instead of manually checking if a company is financially stable, the software does it for you. This allows your team to focus on strategy rather than data entry. For your specific case, if you are sourcing in high-volume manufacturing, these digital tools are non-negotiable.

So what does this mean for you? You should prioritize platforms that offer real-time data. Static databases get old fast. A company that was reliable six months ago might be facing bankruptcy today. Research from the Supply Chain Management Review emphasizes that real-time visibility is the primary driver of supply chain resilience. Using digital tools gives you that visibility from day one. Your next step is to evaluate which platform fits your specific category needs, whether it is a generalist marketplace like Made-in-China or a specialized AI discovery tool.

Industry Networks and the Power of Referrals

Let us cut to what matters. Sometimes the best suppliers are the ones who do not advertise on Google. This is where industry networks and professional referrals come into play. There is a reason this specific aspect confuses people. They assume that digital tools replace networking, but the reality is that they complement each other. A digital search tells you what a company can do, but a referral tells you how they actually behave when things go wrong.

Here is how to apply this. Reach out to your professional network or join industry-specific associations. Ask questions like, “Who are you using for specialized logistics in Western Europe?” or “Who has been the most reliable since the last shipping disruption?” The real question is whether you can trust the information you find online. Referrals provide a layer of vetting that an algorithm simply cannot match. This is one of those areas where getting it right makes a real difference.

We have seen this question come up constantly, so let us settle it. Referrals are not “old school” or outdated. They are a high-signal discovery method. However, you should never rely on them exclusively. Use referrals to find the names, and then use your digital tools to verify their data. This dual-track approach ensures you get the best of both worlds: human insight and data-driven accuracy. The action item here is to maintain an active presence in at least two professional procurement organizations.

Trade Shows and Direct Outreach

Now for the part you actually came here for. How do you find suppliers who are on the cutting edge? Trade shows and conferences remain some of the most effective supplier discovery methods for innovation. While it is time-intensive, meeting a vendor face-to-face allows you to see product demos in person and gauge their corporate culture. Ready for the specifics? Here is the step-by-step breakdown of how to maximize a trade show for discovery.

- Pre-Show Research: Never walk onto a trade show floor without a list of target companies. Use the exhibitor list to identify potential matches before you even leave the office.

- Direct Engagement: Do not just collect brochures. Ask specific questions about their lead times, capacity, and current client load.

- Immediate Documentation: Use a digital note-taking app to record your impressions immediately after leaving a booth. Details fade quickly when you talk to fifty vendors in two days.

Quick reality check here. Trade shows are expensive. If you are a small operation, you might find more value in search engines and direct outreach via LinkedIn. But for large-scale manufacturing or healthcare, where quality standards are rigid, the physical inspection of a supplier’s product at an event is invaluable. According to a study by the Harvard Business Review, face-to-face interactions lead to higher levels of trust and better long-term collaboration. The key difference is the speed at which you can establish a rapport and verify technical capabilities.

The 3-Phase Discovery Workflow

To keep your supplier search organized, we recommend a structured workflow. This prevents you from getting overwhelmed by the sheer volume of data. Let us look at this closely. The process typically unfolds in three distinct phases that move from broad research to a narrow shortlist.

Phase 1: Requirements and Market Mapping

Before you look for a partner, you must know what you are looking for. Define your scope, budget, and timeline. Are you looking for the lowest cost or the highest reliability? You cannot have both. Map the market to understand who the major players are and what the current pricing benchmarks look like. This is the specific answer to how you avoid overpaying.

Phase 2: Active Search and Identification

This is where you execute the methods we have discussed. You use your databases, your networks, and your search engines to find as many potential candidates as possible. At this stage, you are looking for quantity within your quality parameters. Your goal is to find at least ten to fifteen potential vendors to ensure a competitive environment later on.

Phase 3: Initial Screening

Once you have a list, you need to filter it. This is where you issue an RFI (Request for Information). You are not asking for prices yet. You are asking for capabilities, certifications, and references. This is the detail that helps you discard vendors who look good on paper but lack the infrastructure to support your business. To help streamline this, you can utilize a logistics RFP template to structure your inquiries effectively.

Using Spend Analytics to Discover Internal Opportunities

Here is a method most people miss. Sometimes the “new” supplier you need is already in your system under a different department. This is where spend analytics comes into play. By analyzing your internal data, you might find that you are already working with a massive global vendor for one category who can easily handle your new requirements in another category. This is exactly what you need to know to leverage your existing buying power.

The benefit of this method is that the vendor is already vetted. They are already in your payment system. They understand your corporate culture. Finding a “new” supplier through internal discovery can save you weeks of onboarding time. We have seen this work exceptionally well in large multinational corporations where different divisions often operate in silos. Your best move here is to run a spend report across all departments before you start an external search.

What should you do right now? If you have access to procurement software, run a search by “parent company.” You might be surprised to see how many subsidiaries you are already doing business with. This approach reduces the risk of adding too many small, unvetted vendors to your supply chain, which can create a management nightmare down the road. It is about working smarter, not harder.

Transitioning from Discovery to Evaluation

The discovery phase ends when you have a solid shortlist of qualified candidates. But the work is not over. You now need to move into the evaluation phase. This is the specific situation where most procurement professionals stumble. They spend all their time finding the vendor but forget to vet them properly before signing a contract. You need a way to compare these new finds objectively.

In practice, this means you should have a standardized system for ranking your candidates. You are looking at financial stability, operational capacity, and cultural fit. To make this easier, we suggest using a supplier evaluation scorecard template to ensure you are comparing apples to apples. This ensures that the effort you put into discovery actually results in a high-performing partnership.

So which approach works best? A blend is always the answer. Use digital tools for the heavy lifting, networking for the human vetting, and spend analytics for internal efficiency. This multi-layered strategy is what separates amateur sourcing from professional procurement. When you treat discovery as a strategic discipline rather than a quick Google search, the results show up in your bottom line.

Quick Reference: Supplier Discovery Methods at a Glance

- AI Search Engines: Best for rapid, global data aggregation and risk scoring.

- Industry Databases: Best for finding established players in specific categories.

- Professional Referrals: Best for high-trust, high-quality vetting based on experience.

- Trade Shows: Best for discovering innovation and physical product inspection.

- Spend Analytics: Best for identifying existing partners with untapped capacity.

- Direct Outreach: Best for targeting specialized niche vendors.

Common Questions About Supplier Discovery Methods

What is the difference between supplier sourcing and supplier discovery?

The answer is that discovery is a subset of the sourcing process. Discovery is the initial “hunting” phase focused on identification. Sourcing is the entire end-to-end process that includes discovery, evaluation, negotiation, and contracting.

Are digital tools better than manual search methods?

Not necessarily. Digital tools are faster and cover more ground, but manual methods like networking often provide higher-quality insights. Your best move is to use digital tools to build the list and manual methods to verify it.

How many suppliers should I identify during the discovery phase?

The short version is that you should aim for ten to fifteen potential candidates. This allows you to filter them down to a shortlist of three to five for the final bidding process. Starting with too few limits your leverage.

Why is supplier discovery important for risk management?

This is the detail that changes everything. Discovery allows you to find multiple sources for critical components. If you only have one supplier and they fail, your business stops. Discovery builds the redundancy needed for resilience.

Building a robust supply chain requires a proactive approach to finding the right partners. By utilizing diverse supplier discovery methods, you move beyond the status quo and open your business to innovation and increased efficiency. Whether you are leveraging AI databases or walking the floor at a trade show, the goal remains the same: finding partners who align with your strategic goals. Focus on the data, verify through your network, and always keep your pipeline full. This is the way to ensure your procurement process remains a competitive advantage rather than a bottleneck.