Building a Supplier Evaluation Scorecard That Works

Are you tired of relying on gut feelings when it comes time to renew a contract? You have likely been in a situation where a supplier feels “okay” but you lack the hard data to prove they are underperforming. A supplier evaluation scorecard is the specific tool that solves this problem by turning subjective impressions into objective, actionable data. We are going to show you exactly how to build one that does not just track numbers, but actually drives better behavior from your vendors.

If you are reading this, you probably already know that measuring performance is important. You are looking for the detailed breakdown of how to structure these metrics so they actually mean something. This is a specialized deep dive into the mechanics of supplier rating systems. We will cover everything from the core KPIs to the weighting models that prevent price from overshadowing quality. Let us get into the details.

What Exactly is a Supplier Evaluation Scorecard?

The direct answer is that a scorecard is a structured, quantitative tool used to measure and manage supplier performance across predefined criteria. It is sometimes called a vendor scorecard or a supplier rating system. While the names vary, the goal is always the same. It provides a repeatable and transparent basis for making decisions about who stays in your supply chain and who needs to be replaced.

Most organizations use these scorecards to create a “source of truth.” This removes bias from procurement decisions. Instead of arguing about whether a supplier is “good,” you look at a weighted score that accounts for quality, delivery, and cost. This is the detail that changes everything in a negotiation. When you have a report showing a 12 percent defect rate, the conversation shifts from “we think there is a problem” to “here is the specific improvement we require.”

The real question is how you distinguish a scorecard from a vendor evaluation matrix. A matrix is often used during the initial selection phase to compare bidders side by side. A scorecard, however, is a living document. It tracks ongoing performance over months or years. This is a critical part of the strategic sourcing process phases where you move from simple purchasing to long term relationship management.

The Core Dimensions of a High Performing Scorecard

When it comes to supplier assessment criteria, more is not always better. We have seen companies try to track 50 different metrics, only to find that the data becomes too noisy to be useful. Your best move here is to focus on five or six main dimensions that truly impact your bottom line. Let us look at these closely.

1. Quality and Compliance

Quality is usually the highest weighted category because a cheap part that breaks is actually very expensive. You should track the defect rate or nonconformance rate. This is often measured in parts per million or as a percentage of total units received. Beyond just the physical product, you should also evaluate compliance with industry standards like ISO 9001. According to the International Organization for Standardization, maintaining these certifications is a primary indicator of a supplier’s commitment to consistent output.

2. Delivery and Logistics Performance

On-time delivery (OTD) is the gold standard here. But we recommend going a step further by measuring “On-Time In-Full” (OTIF). A shipment that arrives on time but is missing half the order is still a failure. You should also track lead time adherence. If a supplier promises a 14 day lead time but consistently hits 21 days, your production schedule will suffer. This is where you measure order accuracy and the quality of the shipping documentation as well.

3. Cost and Financial Health

This is not just about the unit price. A sophisticated scorecard looks at the total cost of ownership. This includes freight, handling fees, and the cost of managing quality issues. You should also evaluate invoice accuracy. If your finance team spends five hours a week fixing a supplier’s billing errors, that is a hidden cost. Additionally, consider the supplier’s price competitiveness against market benchmarks to ensure you are still getting a fair deal as market conditions shift.

4. Service and Communication

These are the “soft” factors that are often hard to quantify but easy to feel. How quickly do they respond to an emergency? How effective is their problem solving when a shipment goes missing? We recommend using a simple 1 to 5 scale for these qualitative metrics. It allows you to capture the value of a supplier who is flexible and easy to work with, which can sometimes outweigh a slightly higher price point.

5. Risk and Sustainability

Modern procurement requires a focus on Environmental, Social, and Governance (ESG) factors. You need to know if your suppliers are financially stable and if they follow ethical labor practices. High risk suppliers should be identified early so you can begin supplier discovery methods to find alternatives before a crisis hits. Research from organizations like the Harvard Business Review suggests that visibility into lower tier supplier risks is the key to building a resilient supply chain.

Building Your Weighting Model

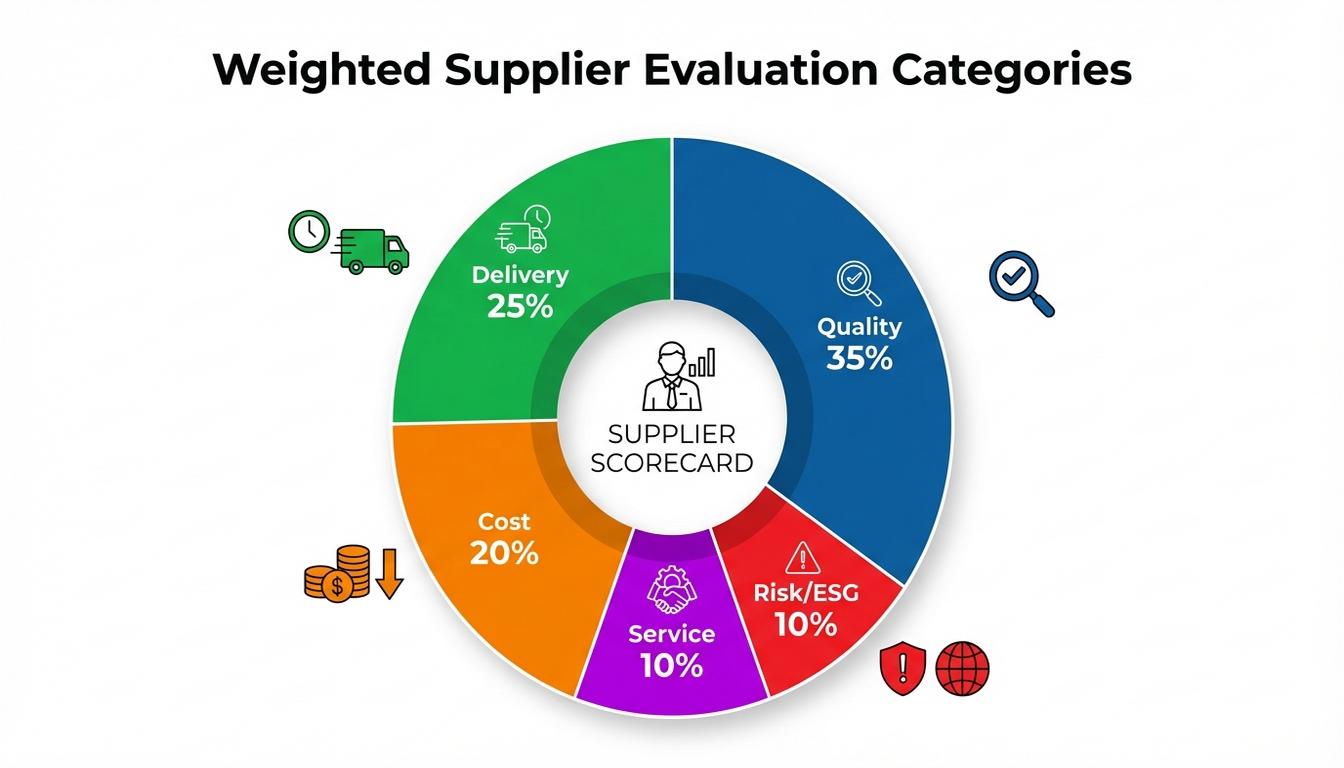

So how do you actually calculate a score? The practical takeaway is that not all KPIs are created equal. You must assign weights to each category based on your specific business priorities. If you are in the medical device industry, quality might be 50 percent of the total score. If you are in a high volume, low margin retail business, cost might take the lead.

Here is what that actually looks like in practice. Imagine a simple 100 point scale:

- Quality: 35% (35 points)

- Delivery: 25% (25 points)

- Cost: 20% (20 points)

- Service: 10% (10 points)

- Risk/ESG: 10% (10 points)

For each category, you rate the supplier on a scale of 1 to 5. You then multiply that rating by the weight. For example, if a supplier gets a 4 out of 5 on quality, their weighted score for that category is 28 (4/5 * 35). Summing these up gives you a composite supplier ranking. This allows you to categorize them as “Preferred,” “Approved,” or “Conditional.”

Now for the part you actually came here for. How do you handle a supplier who is great at delivery but terrible at quality? The weighting model handles this naturally. A perfect delivery score cannot save a supplier if they are failing in the most heavily weighted category. This structure prevents internal stakeholders from playing favorites based on who is “nice” to work with versus who actually delivers results.

The Step-by-Step Breakdown for Implementation

Ready for the specifics of rolling this out? Do not try to do everything at once. Start with your top ten most critical suppliers and expand from there. Here is the step-by-step breakdown of how to get your first scorecard running.

- Define Your Goals: Are you trying to reduce costs or improve lead times? Your metrics must align with these outcomes.

- Select Your KPIs: Choose 5 to 7 high impact metrics. Ensure you have a reliable data source for each one.

- Standardize the Rating Scale: Use a consistent 1 to 5 or A to F scale across the whole company. This ensures “apples to apples” comparisons.

- Gather the Data: Pull transactional data from your ERP or finance systems. For qualitative metrics, use a standardized survey for internal stakeholders.

- Review with the Supplier: This is the step most people miss. Share the results with the supplier. Transparency builds trust and gives them a roadmap for improvement.

Your next step after gathering this data is to use it during your next contract negotiation. If you are preparing to send out a logistics rfp template, the scorecard data from your current providers will tell you exactly what requirements you should emphasize in the new bids.

Quick Reference: Supplier Scorecard at a Glance

- Frequency: Review monthly for transactional data, quarterly for full strategic reviews.

- Metrics Count: Aim for 5 to 7 core KPIs to avoid data fatigue.

- Scoring: Use weighted averages to prioritize quality and reliability over price alone.

- Transparency: Always share scores with suppliers to foster a collaborative relationship.

- Action: Poor scores should trigger a Corrective Action Plan (CAP), not just a penalty.

Common Pitfalls to Avoid

Even with a great template, things can go wrong. One of those areas where getting it right makes a real difference is data integrity. If your data is manual and prone to errors, the supplier will spend the entire meeting arguing about the numbers instead of how to improve. Whenever possible, automate the data collection from your financial and logistics systems.

Another mistake is treating the scorecard as a weapon. If you only use it to beat down suppliers for lower prices, they will eventually stop being transparent with you. The real value of a supplier grading system is in development. Use the data to identify where the supplier is struggling and offer support. Maybe their late deliveries are caused by your own internal process of changing orders at the last minute. The scorecard should reveal these bottlenecks on both sides.

Quick reality check here. Is your scorecard static? Market conditions change. A metric that was vital three years ago might be irrelevant now. We recommend reviewing your scorecard criteria once a year to ensure they still reflect your current business strategy. This is especially true as sustainability and carbon footprint metrics become more standardized across global supply chains.

Common Questions About Supplier Evaluation Scorecards

How often should we update our supplier scorecards?

The answer depends on the volume of transactions. For high volume suppliers, you should track hard metrics like OTIF and defect rates monthly. For strategic, long term partners, a comprehensive quarterly review that includes qualitative service metrics is the industry standard. This keeps the relationship focused on continuous improvement without becoming a daily administrative burden.

What if a supplier disagrees with their score?

This is actually a good thing. It means they care about the relationship. When a dispute happens, the best move is to look at the raw data. If your scorecard is built on clear definitions and verified data sources, you can easily show them the specific orders or quality reports that led to the score. Use this as an opportunity to align your definitions of “on-time” or “acceptable quality.”

Can we use the same scorecard for every supplier?

Not quite. While the general framework remains the same, the specific KPIs and weights should change based on the category. A software vendor should not be evaluated on the same criteria as a raw materials supplier. You might keep the same 5 dimensions but change the individual metrics. For example, “uptime” would replace “defect rate” for a service provider.

Should we automate the scorecard process?

Yes, as much as possible. Manual spreadsheets are the enemy of consistency. Modern SRM (Supplier Relationship Management) systems can pull data directly from your ERP. This ensures the data is objective and reduces the time procurement teams spend on administrative work. If you are a smaller firm, even a simple automated data pull into a centralized spreadsheet is better than manual entry.

Moving From Data to Action

The practical takeaway is that a scorecard is only as good as the actions it inspires. If you collect this data and then file it away, you have wasted your time. The real magic happens when you use these scores to drive performance. High performing suppliers should be rewarded with more volume or longer contracts. Underperforming suppliers should be put on a formal improvement plan with clear deadlines.

When it comes to supplier evaluation scorecards, the details matter. You are building a system that rewards the best partners and protects your company from risk. By focusing on weighted, objective data, you move procurement from a back office function to a strategic advantage. Your best move now is to pick your most critical supplier and try building a basic scorecard for them this week. You will be surprised at what the data reveals once you stop relying on intuition alone.

For a complete overview of the broader procurement lifecycle, check out our main guide on the strategic sourcing process phases. This will help you see exactly where performance management fits into your overall supply chain strategy. Start measuring today, and you will see the results in your bottom line tomorrow.