The Strategic Sourcing Process From Start to Finish

Looking at your company’s spending can feel like constantly putting out fires. One day it’s a sudden price hike from a long-term supplier, and the next, a critical shipment that never shows up. It feels like you are caught in a cycle of transactional buying where the only goal is to get what you need right now at the lowest price you can find today. If this sounds familiar, you are certainly not alone. Many procurement teams start out this way because it is how things have always been done. But there is a better way to handle your supply chain, and it is called the strategic sourcing process.

We know how overwhelming it can be when you realize your current approach is not scaling. You might be hearing terms like category management or total cost of ownership and wondering how they all fit together. You are looking for a roadmap that does more than just help you buy things. You want a strategy that actually adds value to your business and helps you sleep better at night knowing your supply chain is resilient. We have been there, and we want to help you make sense of it all. This guide is here to walk you through every single step of the journey, from the first time you look at your spend data to the moment you are managing a high-performing partnership with a key supplier.

What we found is that strategic sourcing is not just a fancy way of saying “shopping for deals.” It is a complete shift in how an organization thinks about its resources. In this guide, we are going to break down the entire sourcing lifecycle. We will look at why the lowest price is often a trap, how to actually vet a supplier so you are not surprised later, and what steps you can take to make your procurement process more data-driven. We will also share some practical tools and strategies that we have seen work in the real world. Let us get into it.

What Exactly Is Strategic Sourcing?

Before we get into the nitty-gritty steps, we need to clear up what we are actually talking about. Strategic sourcing is a systematic, data-driven approach to acquiring goods and services. It is about aligning your purchasing decisions with your organization’s broader business objectives. Instead of just focusing on the lowest price for a single transaction, we are looking at big-picture goals like total cost management, risk reduction, and innovation.

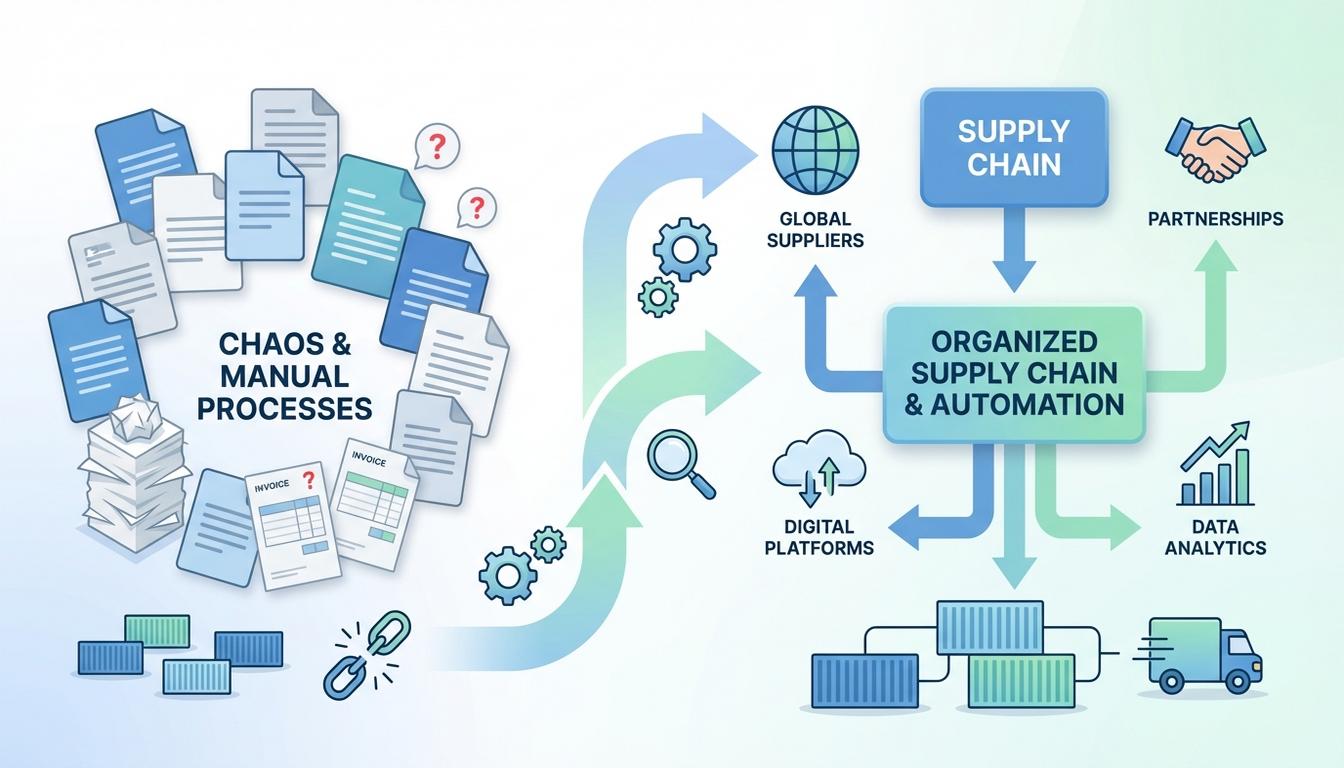

Here is the thing. Traditional procurement is often tactical. It is about getting a specific item from point A to point B right now. Strategic sourcing, on the other hand, is about looking at the entire landscape. It analyzes spend patterns, anticipated future needs, and the health of the supply markets. It transforms procurement from a back-office task into a strategic business activity that actually helps your company compete. When you do this right, you are not just a “buyer” anymore. You are a value creator for your company.

How It Differs From Traditional Procurement

Let us be honest here. Most people use “sourcing” and “procurement” interchangeably, but they are quite different. Traditional or tactical procurement usually focuses on the short term. The goal is simple: find the lowest unit price for a specific order. There is not much thought given to what happens after the contract is signed or how that supplier fits into your long-term plans. It is very transactional.

Strategic sourcing flips that on its head. It emphasizes the Total Cost of Ownership (TCO). This means we are looking at more than just the price tag. We are considering logistics, inventory costs, quality control, the cost of switching suppliers, and even the environmental impact. According to research from SAP Taulia, modern sourcing is heavily oriented toward broader business objectives and the use of technology to gain a competitive advantage. It is about building a relationship that lasts and grows with your needs.

The Core Concepts You Need to Know

To really master this, you have to get comfortable with a few key terms. Think of these as the building blocks of your sourcing methodology. Here is a quick breakdown of what they actually mean in the real world:

- Sourcing Methodology: This is the codified, step-by-step framework you use to make sure you are consistent. It prevents you from skipping steps when things get busy.

- Sourcing Lifecycle: This is the end-to-end cycle. It starts with analyzing your spend and ends with managing a supplier’s performance until it is time to source that category again.

- Category Sourcing: This is when you apply your strategy to a specific group of similar items, like IT equipment or raw materials. It lets you become an expert in that specific market.

- Procurement Sourcing Strategy: This is your overall plan. It defines whether you want one big supplier or several small ones, and whether you are looking for a local partner or a global powerhouse.

What this means for you is that you are no longer just reacting to requests. You are planning ahead. You are looking at the market and saying, “How can we do this better?” Now, you might be wondering how you actually go from a messy spreadsheet of invoices to a streamlined strategy. That is where the process comes in.

The 8-Step Strategic Sourcing Process

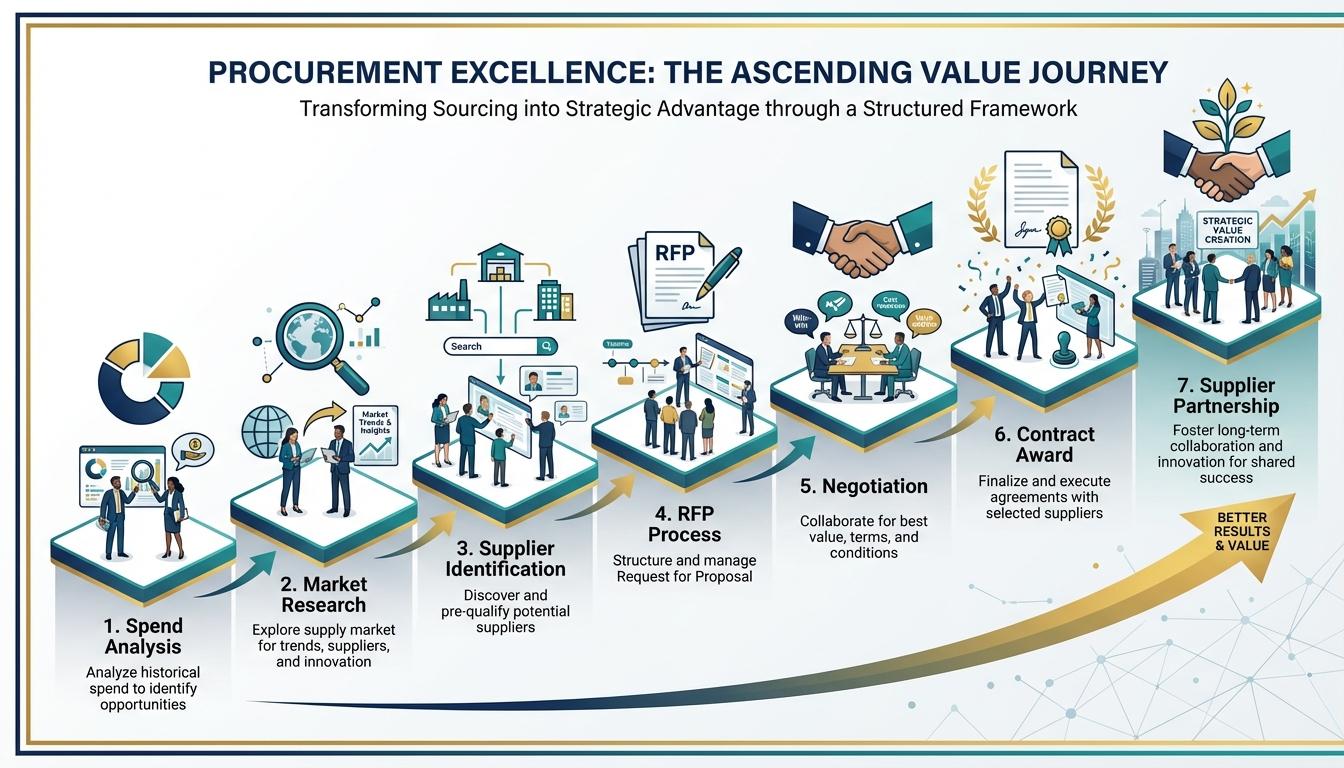

There are a few different ways to slice this, but we find that the 8-step model used by industry leaders like NetSuite provides the most clarity. It covers everything from the initial data gathering to the long-term relationship management. Let us break this down step by step so you can see how it works in practice.

Step 1: Evaluate Current Expenditures

This is where it all begins. You cannot know where you are going if you do not know where you have been. You need to gather all your data on who is buying what, which department is spending the most, and which suppliers are getting your money. This is often called a spend analysis.

Most companies are surprised by what they find here. You might realize you are buying the same type of office supplies from five different vendors at five different price points. By categorizing your spend into direct materials, indirect goods, and services, you can start to see where you have the power to consolidate. The goal here is to find the “low-hanging fruit” where you can save money or simplify things quickly. If you want a deeper look at how to find new partners once you’ve identified these gaps, you should check out our guide on supplier discovery methods.

Step 2: Perform Supply Market Analysis

Once you know what you are spending, you need to look outside your own walls. What does the market actually look like right now? Are there only a few big players who can provide what you need, or is the market full of small, hungry startups? You need to understand the cost drivers in the industry. For example, if you are sourcing logistics services, you need to know what is happening with fuel prices and driver availability.

This is the part most guides skip over, but it matters. Market analysis helps you understand your leverage. If the market is highly competitive, you can push for better terms. If it is a monopoly, you might need to focus more on building a strong relationship to ensure you get the supply you need. You are looking for trends that could affect your supply chain in the next two to five years.

Step 3: Conduct a Comprehensive Cost Assessment

Remember when we mentioned Total Cost of Ownership (TCO)? This is the step where you calculate it. You need to look beyond the invoice price. Here is what actually matters in this assessment:

- Logistics and Transportation: How much does it cost to get the item to your facility?

- Inventory Costs: How much money is tied up in stock?

- Quality and Maintenance: If the item breaks or fails, what is the cost of downtime?

- Switching Costs: If you leave your current supplier, what will it cost to train your team on a new system?

In simple terms, a cheap part that breaks often is much more expensive than a high-quality part that costs 10% more upfront. You have to be able to explain this to your finance team so they understand why you are not always picking the lowest bidder.

Step 4: Define a Supplier Identification Process

Now that you know what you need and what the market looks like, it is time to find the people who can help you. You need a structured way to identify and prequalify potential partners. This is not just about a Google search. You should be looking at industry reports, trade show directories, and internal databases.

The key here is prequalification. You want to make sure a supplier is financially healthy, has the right certifications, and shares your company’s values regarding sustainability and ethics. You do not want to get halfway through a negotiation only to find out they cannot handle your volume. This is why having a standardized supplier evaluation scorecard template is so helpful. It allows you to compare different companies on an apples-to-apples basis.

Step 5: Formulate a Sourcing Strategy

This is where you make the big decisions. You have all your data, and now you have to decide on the “how.” Will you go with a single supplier to get the best possible volume discount? Or will you use multiple suppliers to reduce the risk of a total shutdown if one has a problem? This is the heart of your procurement sourcing strategy.

You also need to decide on the type of relationship you want. Some categories are fine being transactional. If you are buying pens, you probably just want the best price and easy delivery. But if you are sourcing a critical component for your main product, you might want a long-term partnership where you work together on innovation. Your strategy should be a direct reflection of your business goals. For instance, if your company’s goal is “resilience,” your sourcing strategy will likely prioritize regional suppliers over global ones to avoid shipping delays.

Step 6: Negotiate with Suppliers

Now we get to the part everyone thinks of when they hear the word “sourcing.” Negotiation. But because you have done all the prep work in steps 1 through 5, you are in a much stronger position. You are not just asking for a lower price. You are negotiating on service levels, payment terms, quality standards, and lead times.

What we found is that the best negotiations are not a battle. They are a search for mutual value. Maybe you can offer a longer contract in exchange for a lower price, or maybe you can adjust your delivery schedule to help the supplier optimize their warehouse. The goal is to reach an agreement that is sustainable for both sides. If the supplier feels cheated, they will eventually cut corners, and that will hurt you in the long run.

Step 7: Implement Sourcing Model Changes

This is where the rubber meets the road. You have signed the contract, and now you have to actually make the change. This part is often harder than it looks. You have to transition to the new supplier, set up the workflows in your systems, and make sure your internal stakeholders know how to place orders.

Communication is vital here. If your operations team is used to calling “Joe” at the old supplier, they might be frustrated when they have to use a new portal. You need to explain the “why” behind the change and show them how the new partnership will make their lives easier. A smooth implementation is what separates a great strategy from a failed one.

Step 8: Monitor and Assess Performance Continuously

One of the biggest mistakes we see is companies that think the job is done once the contract is signed. In reality, the work is just beginning. You need to continuously track Key Performance Indicators (KPIs) to make sure the supplier is doing what they promised. Are they delivering on time? Is the quality consistent? Are they responding to your emails?

This is part of the sourcing lifecycle. By monitoring performance regularly, you can catch small issues before they become disasters. It also gives you the data you need for the next time you go through this process. If a supplier is knocking it out of the park, you will know to stick with them. If they are struggling, you will have the evidence you need to either help them improve or find a better fit. As NetSuite points out, this continuous monitoring is what turns a one-time win into a long-term advantage.

The Role of Category Sourcing and Management

You might be thinking, “This process sounds great, but how do I apply it to everything from lightbulbs to software licenses?” The answer is category sourcing. You cannot treat every purchase exactly the same way. Category management is the practice of grouping similar products and services together so you can manage them as a single business unit.

Let us break this down. When you group your spend into categories, you can assign experts to lead them. For example, someone who understands the nuances of the global shipping market will be much better at sourcing logistics than someone who usually buys office furniture. These category leads build deep market knowledge and long-term roadmaps for their specific area.

Here is something most guides do not mention. Category management is not just about the sourcing event. It is about the entire life of that category within your company. It involves looking at how the items are used, finding ways to reduce waste, and keeping an eye on new technology that might make the entire category obsolete. It is a more holistic way of looking at your business.

Navigating the Supplier Sourcing Process

Within the bigger strategic sourcing framework, there is a very specific workflow for actually picking a vendor. We call this the supplier sourcing process. This is the “technical” part of the job where you use tools like RFIs, RFPs, and RFQs to gather information and make a choice.

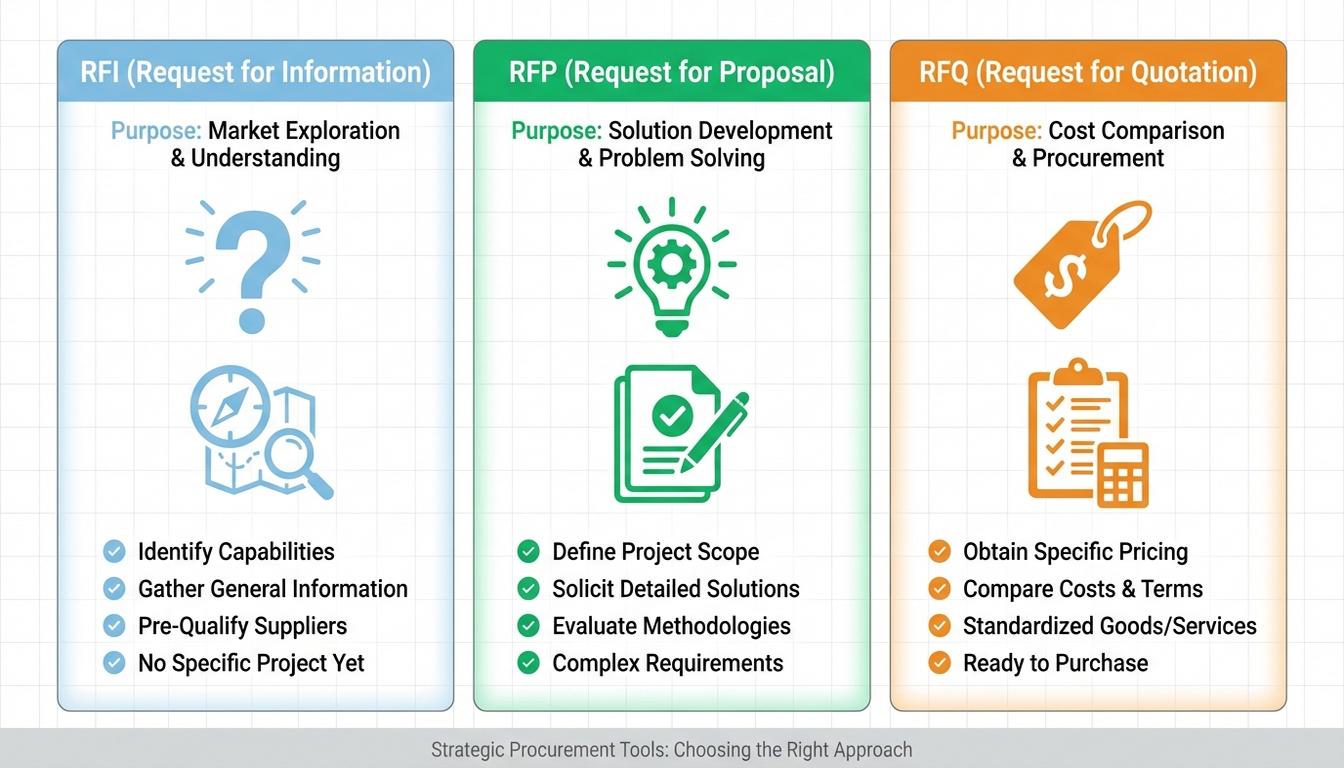

Understanding the RFx Landscape

You will hear people talk about “RFx” all the time. The “x” is just a placeholder for different types of requests. Here is the practical takeaway on which one to use and when:

- RFI (Request for Information): Use this when you are just exploring. You want to know what is possible in the market and which suppliers are interested in working with you. It is high-level and non-binding.

- RFP (Request for Proposal): This is the heavy lifter. You use this when you have a problem and you want suppliers to propose a solution. It covers everything from technical specs to commercial terms. If you are looking for a place to start, we have a logistics RFP template that can save you a lot of time.

- RFQ (Request for Quotation): Use this when you know exactly what you want and you just need a price. This is common for commodities or well-defined parts.

Evaluating the Proposals

Once the responses come in, you need a way to grade them that isn’t just “I like their logo.” This is where you use that multi-criteria scoring system we mentioned earlier. You should be looking at price, of course, but also at their capacity to grow with you, their financial stability, their ESG (Environmental, Social, and Governance) scores, and their technical expertise.

Here is why this matters. A supplier might have the lowest price but a terrible record for on-time delivery. If you only look at the price, you are setting yourself up for a disaster. By using a weighted scorecard, you can see that the supplier who is slightly more expensive but 100% reliable is actually the better choice for your business. It takes the emotion and guesswork out of the decision.

The Benefits: Why This Matters for Your Bottom Line

At this point, you might be thinking that this sounds like a lot of work. And let us be real for a moment. It is. It takes time to gather data, analyze markets, and build these relationships. So, what is the “so what” moment? Why should your company invest in the strategic sourcing process? The benefits go way beyond just a smaller bill at the end of the month.

Cost Reduction and TCO Optimization

Yes, you will save money. By consolidating your spend and negotiating from a position of data-driven strength, you will almost certainly find price savings. But the real win is in TCO optimization. When you reduce the cost of quality issues, shipping delays, and inventory glut, you are saving money that usually stays hidden in the “cost of doing business.” According to experts at Ivalua, a structured process leads to better overall value, not just lower prices.

Improved Risk Management and Resilience

If the last few years have taught us anything, it is that supply chains are fragile. Strategic sourcing helps you build resilience. By diversifying your supplier base and doing deep market research, you can anticipate disruptions before they happen. You won’t be caught off guard when a single factory halfway around the world shuts down because you will have already mapped out your alternatives. This peace of mind is invaluable.

Innovation and Supplier Partnerships

When you move away from transactional buying, you start to see your suppliers as partners. These companies are experts in what they do. By building a strategic relationship, you can tap into their expertise. Maybe they have a new material that can make your product lighter, or a new process that can speed up your production. When you work together, you create value that neither of you could achieve alone.

Enablers: Technology and Governance

You do not have to do all of this with just a pencil and paper. In fact, in a modern organization, you probably can’t. There are two main things that enable a successful sourcing methodology: technology and clear governance.

The Power of Digital Platforms

Modern sourcing relies on digital tools to manage the massive amount of data involved. Spend analytics dashboards can show you exactly where your money is going in real-time. Contract lifecycle management (CLM) tools make sure you never miss a renewal date or a scheduled price adjustment. These platforms allow your team to spend less time on data entry and more time on actual strategy. They provide a “single source of truth” that everyone in the company can trust.

The Importance of a Formal Methodology

Technology is great, but it only works if you have a process to follow. This is where governance comes in. You need clear roles and responsibilities. Who has the final say on a supplier choice? What are the approval workflows? Having a formal methodology, like the three-phase framework used by the South African National Treasury, ensures that everyone is playing by the same rules. It standardizes best practices and makes sure that the quality of your sourcing does not depend on which person is running the project.

How to Start Implementing Strategic Sourcing

If you are ready to make the shift, you do not have to change everything overnight. In fact, we recommend you don’t. The best way to start is to pick one high-impact category and use it as a pilot program. Here is a simple way to get moving:

- Gather Your Spend Data: Get your hands on every invoice from the last 12 months. Clean it up and see what stories it tells you.

- Identify Quick Wins: Look for areas with a lot of different suppliers for the same item. Consolidation is often the easiest way to show value quickly.

- Build a Cross-Functional Team: Do not do this in a procurement vacuum. Bring in people from finance, operations, and even the technical side. They see things you don’t.

- Run a Pilot Sourcing Wave: Take your chosen category through the 8-step process. Document everything and learn from the hiccups.

- Share the Results: When you save money or improve quality, shout it from the rooftops. Show the leadership team the “so what” of your efforts.

Stay with us here because this part is important. Strategic sourcing is a marathon, not a sprint. It is a continuous cycle of improvement. Once you finish one category, you move to the next, while still monitoring the first. Over time, this becomes the way your company does business, and that is when the real transformation happens.

Frequently Asked Questions

What are the main steps in the strategic sourcing process?

Great question. While different models exist, most authoritative sources agree on a 7 to 8 step process. It typically includes spend analysis, market research, creating a sourcing strategy, identifying suppliers, running an RFx process, negotiating terms, implementing the change, and then continuously managing the supplier’s performance. The goal is to make the process repeatable and data-driven rather than a one-off event.

How is strategic sourcing different from traditional procurement?

This is where most people get confused. Traditional procurement is tactical and transactional. It focuses on the lowest price for a single purchase. Strategic sourcing is a long-term, holistic view. It looks at the Total Cost of Ownership (TCO), manages risks, and aims to build strategic partnerships that align with the company’s overall goals. In simple terms, one is about saving pennies today, while the other is about creating value for years.

What exactly is a procurement sourcing strategy?

A procurement sourcing strategy is your game plan for a specific category of spend. It defines how you will approach the market to get the best value. This includes deciding whether you want a single or multi-source setup, choosing between global or local suppliers, and determining your stance on risk and sustainability. It is the “why” and “how” behind your buying decisions.

What role do RFIs, RFPs, and RFQs play?

These are the tools used during the supplier sourcing process to gather data and compare options. An RFI is for broad information gathering. An RFP is for complex problems where you want the supplier to propose a solution. An RFQ is for simple price comparisons on well-defined items. Together, they bring structure and objectivity to the selection process so you can make the best choice for your business.

Why is strategic sourcing important for supply chain resilience?

This comes up a lot lately, and the answer is simple. Strategic sourcing forces you to look at the market and your risks deeply. Instead of just buying from the easiest source, you analyze potential disruptions and build backups. By diversifying your suppliers and building stronger relationships with them, you create a supply chain that can bend without breaking when things go wrong in the world.

Moving Forward with Your Sourcing Journey

You have made it this far, and that means you are already ahead of most people when it comes to understanding how modern procurement works. We have covered a lot of ground today, from the basic definitions to the deep complexities of the 8-step process and the power of category management. What we found is that the most successful organizations are the ones that treat sourcing as a living, breathing part of their business strategy.

The journey from tactical buying to strategic sourcing might feel like a mountain to climb, but the view from the top is worth it. You will have more control over your costs, a deeper understanding of your risks, and much stronger relationships with the partners who keep your business running. You will be moving from a reactive “firefighting” mode to a proactive “value creation” mode. And that is a very good place to be.

Now you have everything you need to start transforming your process. The next step? Go find that spend data and see what it tells you. You might be surprised by what you find hidden in those invoices. If you have questions or need a template to get started, we have linked some of our favorite resources throughout this guide. You have got this. Let us know how your first sourcing wave goes.